Disclaimer

This is a Tax Practitioners Board (TPB) Information Sheet (TPB(I)). It is intended to be for information only. It provides information regarding the TPB’s position on the approval process for course providers who seek to offer Board approved courses referred to in Schedule 2 of the Tax Agent Services Regulations 2022. While it seeks to provide practical assistance and explanation, it does not exhaust, prescribe or limit the scope of the TPB’s powers in the Tax Agent Services Act 2009 (TASA).

In addition, please note that the principles, explanations and examples in this paper do not constitute legal advice and do not create additional rights or legal obligations beyond those that are contained in the TASA or which may exist at law.

Document History

The TPB released this document as an exposure draft on 17 December 2010 and the TPB invited comments and submissions in relation to the information contained in it. The closing date for submissions was 28 February 2011. The TPB considered the submissions made and, on 26 May 2011, published a final TPB(I).

On 8 September 2011 the following amendments were made:

- amended paragraph 8 by incorporating recent developments in the establishment of the Tertiary Education Quality and Standards Agency (TEQSA)

- amended paragraph A5 by inserting the word “quality” before the word “review”

- changed the title of the document referred to within the TPB(I) from “Approval process for courses which are referred to in Schedule 2 of the Tax Agent Services Regulations 2009” to “Approval process for course providers”.

On 19 June 2015, the TPB updated the TPB(I) to incorporate relevant requirements relating to tax (financial) advisers.

On 1 January 2022, the TPB updated the TPB(I) to remove references to tax (financial) advisers.

On 1 April 2022, the TPB updated this TPB(I) to replace references from the repealed Tax Agent services Regulations 2009 to Tax Agent Services Regulations 2022.

Issued: 19 June 2015

Last updated: 1 April 2022

Introduction

- This TPB(I) sets out the views of the Tax Practitioners Board (TPB) in relation to its approval process for course providers who seek to offer Board approved courses referred to in Schedule 2 of the Tax Agent Services Regulations 2022 (TASR).

- The purpose of this TPB(I) is to assist providers other than universities, registered training organisations (RTOs) or other registered higher education institutions to understand the factors that the TPB will consider when determining whether a provider may be approved by the TPB. As an approved course provider, the courses they provide will be capable of being considered for approval by the TPB for the purposes of Schedule 2 of the TASR as part of the TPB’s approval process.

The approval process consists of two steps:

- Generally, a course will be approved by the TPB where the course meets all the relevant course requirements (as identified by the TPB), and where it is provided by an approved course provider.

- This TPB(I) sets out the views of the TPB as to who is an approved course provider.

- The TPB is of the view that where a course is provided by a university, RTO or other registered higher education institution (for example, a non self-accrediting higher education institution), there are:

- sufficient quality assurance safeguards in place to ensure that the course is provided according to appropriate professional and educational standards

- the course provider has sufficient internal mechanisms to be sustainable.

- The TPB recognises that universities are subject to regulatory activities and quality assurance mechanisms undertaken by the Tertiary Education Quality and Standards Agency (TEQSA). TEQSA has been established as an independent body with powers to regulate university and non-university higher education providers, monitor quality and set standards.

- Similarly, the TPB recognises that RTOs are subject to regulatory activities and quality assurance mechanisms undertaken by the Australian Skills Quality Authority (ASQA), the national regulator for the vocational education and training (VET) sector.

- Finally, the TPB appreciates that there may be other registered higher education institutions, such as non self-accrediting higher education institutions. The TPB recognises that these types of institutions must seek registration as a higher education institution with government accreditation authorities, and course accreditation for each of the higher education courses they offer.

- To remove any doubt, this TPB(I) does not discuss the particular course requirements of the various Board approved courses (see paragraphs 11 to 13 below). These requirements are contained in separate proposed guidelines and information sheets which the TPB has issued (see paragraph 14 below).

Background

- Applicants seeking registration as a tax agent under the Tax Agent Services Act 2009 (TASA) are generally required to have successfully completed one or more of the following courses:

- a course in Australian taxation law that is approved by the Board

- a course in commercial law that is approved by the Board

- a course in basic accountancy principles that is approved by the Board.

- Applicants seeking registration as a BAS agent under the TASA are required to have successfully completed a course in basic GST/BAS taxation principles that is approved by the Board.

- The TPB has issued proposed guidelines and information sheets which outline its approach to the requirements of the following courses:

- a course in Australian taxation law that is approved by the Board for tax agents (TPB(PG) 03/2010)

- a course in commercial law that is approved by the Board for tax agents (TPB(PG) 02/2010)

- a course in basic accountancy principles that is approved by the Board for tax agents (TPB(PG) 01/2010)

- a course in basic GST/BAS taxation principles that is approved by the Board (TPB(I) 04/2011)

- a course in Australian taxation law that is approved by the Board for tax agents with a (financial) advice condition (TPB(PG) 04/2014)

- a course in commercial law that is approved by the Board for tax agents with a tax (financial) advice services condition (TPB(PG) 05/2014).

- Under Schedule 2 of the TASR, the TPB has the power to approve a course by an approval process, an accreditation scheme, or by other means. The TPB is of the view that its approval process involves two steps:

- first, the course must be provided by an approved course provider, and

- second, the course provided must be an approved course for the purposes of Schedule 2 of the TASR.

- In relation to who may qualify as an approved course provider, the TPB is of the view that a key objective in relation to the approval of courses is to ensure that there is a high quality of education, training and assessment consistent with that required of universities and RTOs who are subject to established quality assurance frameworks which govern the range of courses which they offer. This is to assure the TPB that applicants seeking registration as a tax agent or BAS agent have learned or acquired the relevant content or skills or both in a course from a provider that has appropriate quality assurance frameworks in place relating to the provision of the courses which they offer.

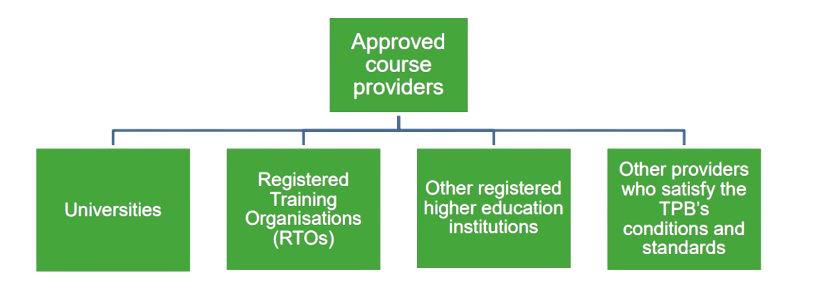

- To assist course providers who are not universities, RTOs or other registered higher education institutions, the TPB has developed a set of conditions and standards that must be met to the satisfaction of the TPB before it is in a position to consider whether courses offered by such providers will be considered for approval for the purposes of Schedule 2 of the TASR.

- In articulating these conditions and standards, the TPB has had regard to best practice standards including the Australian Quality Training Framework (AQTF) Essential Standards for Initial Registration.

The range of possible approved course providers may be summarised as follows:

Proposed conditions and standards

- The TPB is of the view that course providers other than universities, RTOs or other registered higher education institutions who are seeking to provide an approved course for the purpose of Schedule 2 of the TASR must meet minimum conditions and standards in relation to all of the following four areas:

- trainers and assessors

- administrative functions

- course requirements

- management systems.

- Proposed course providers will need to provide a submission to the TPB addressing all of the conditions and standards (which are detailed below) relating to each of these four areas to enable the TPB to consider whether they qualify as an approved course provider under the TPB's approval process.

- Submissions will need to include a certification from an appropriately qualified and independent person that all of the conditions and standards as detailed in this TPB(I) are satisfied. Such persons could include, but need not be limited to, leading academics in the relevant area. For example, if the course provider intends submitting an application in relation to an approved course in Australian taxation law, then a professor in that relevant discipline may be an appropriate certifier.

- The TPB recognises that it may be necessary to engage different individuals to provide certification in relation to different conditions and standards as detailed in this TPB(I). The TPB reserves the right to request additional certification if it is not satisfied that all the conditions and standards as detailed in the TPB(I) have been met.

- Proposed course providers may, prior to making a submission for approval as an approved course provider, submit to the TPB the name and details of suitable individuals they intend to engage for the purpose of obtaining the necessary certification. All submissions should be made in writing and sent to courseprovider@tpb.gov.au.

- Any costs relating to procuring and providing a certification will be the sole responsibility of the applicant.

- The TPB will require a periodic review of each approved course provider to ensure that they are continuing to meet all of the conditions and standards detailed below. The TPB is of the view that this periodic review will occur every three years from when a course provider first gains recognition as an approved course provider under the TPB’s approval process.

- A periodic review of an approved course provider will require the course provider to reapply for approval by making a submission to the TPB which demonstrates that they continue to meet all of the conditions and standards as detailed in this TPB(I). The submission will need to include a certification from an appropriately qualified and independent person that all of the conditions and standards as detailed in this TPB(I) are satisfied (see paragraphs 22 to 25 for further information regarding certification).

- An approved course provider must comply with the TPB’s requests in relation to any periodic review of the course provider.

- Any costs relating to the periodic review of an approved course provider will be the sole responsibility of the course provider.

- Notwithstanding the above, an approved course provider must, as soon as practicable, notify the TPB if there is any material change to any of the conditions and standards in relation to the course provider, and also to any faculty or department to which the course provider belongs.

- The minimum conditions and standards set out in this document are subject to change at the discretion of the TPB.

A) Trainers and Assessors

A1. The proposed course provider must at all times have a sufficient number of qualified teachers, trainers and assessors to deliver the relevant course(s).

A2. The proposed course provider must ensure that all teachers, trainers and assessors of the relevant course:

- hold the necessary educational and experience qualifications necessary to carry out the education, training and assessment

- have a suitable level of demonstrated experience and current industry skills to deliver the course effectively

- continue to develop their educational training knowledge and skills as well their industry knowledge, and can demonstrate this.

A3. The proposed course provider must have procedures in place for conducting the assessment of the relevant course, including recognition of prior learning (RPL).

A4. The proposed course provider must have procedures in place for monitoring the delivery of education, training and assessment.

A5. The proposed course provider must have strategies in place for the quality, review and enhancement of education, training and assessment processes. These strategies should be developed with reference to the TPB’s relevant course requirements and the tax agent services industry.

B) Administrative functions

B1. The proposed course provider must have defined procedures to manage the administrative functions of the business.

B2. The proposed course provider must have strategies for the continuous improvement of its administrative functions.

B3. The proposed course provider must have an adequate student record system, including unique student identifiers.

B4. The proposed course provider must have procedures in place to ensure that students have access to their personal records.

B5. The proposed course provider must have adequate procedures for the retention, archiving, retrieval and transfer of records which maintains their accuracy and integrity. Student records of attainment must be retained for a period of 30 years.

B6. The proposed course provider must inform students of their rights and obligations, and outline its commitments to the student in relation to the relevant course.

B7. The proposed course provider must have adequate procedures for dealing with, and resolving, complaints and appeals.

B8. The proposed course provider must have procedures dealing with issues of academic misconduct (eg plagiarism).

C) Course requirements

C1. The proposed course provider must ensure that relevant courses provided adhere to the TPB's specific requirements in relation to, among other things, content, competencies and assessment. Further information about the TPB's specific requirements in relation to particular courses for the purposes of Schedule 2 of the TASR, refer to the TPB Proposed Guidelines.

C2. The proposed course provider must identify how a student’s successful completion of a course will be acknowledged. For example, this may be by a qualification, certificate or statement of attainment.

C3. The proposed course provider must be capable of efficiently managing and implementing any future changes to course requirements, including those relating to, among other things, content, competencies and assessment. To satisfy this requirement, the proposed course provider must be able to demonstrate to the satisfaction of the TPB that it has quality assurance mechanisms in place that govern curriculum review and development – e.g., what processes are in place and what mechanisms govern this process.

C4. The proposed course provider will be required to demonstrate that it undertakes periodic course reviews – e.g., annual and comprehensive course reviews including details of who undertakes them.

C5. The proposed course provider must have developed processes to seek student and client feedback with a view to the continuous improvement of course delivery.

C6. The proposed course provider must have developed mechanisms to ensure that the educational, assessment and support requirements of students are capable of being met.

C7. The proposed course provider must ensure that students are provided with or have access to appropriate materials, equipment and trainers.

D) Management systems

D1. The proposed course provider must have a developed business plan.

D2. The proposed course provider must have the necessary infrastructure and resources which supports education, training and assessment.

D3. The proposed course provider must remain financially viable and deliver quality education, training and assessment. To substantiate this, the proposed course provider should provide an independent assessment of its financial viability risk, including independent evidence of its financial records being audited as part of its submission to the TPB.

D4. The proposed course provider must provide fee information to students in a clear and transparent manner.

D5. The proposed course provider must be able to demonstrate that decision making of management is undertaken with reference to the experience of its teachers, trainers and assessors.

D6. The proposed course provider must advise the TPB of significant changes to its operations or ownership or both.

D7. The proposed course provider must hold insurance for public liability.

D8. The proposed course provider must comply with relevant Commonwealth, State and Territory legislation.

D9. The proposed course provider must maintain knowledge of educational, training and industry developments relevant to the courses it provides.

Requests for approval of course provider

- Course providers, other than universities, RTOs and other registered higher education institutions, who have satisfied all the conditions and standards as detailed in this TPB(I) may make a request for approval as an approved course provider. All requests must be made in writing and include all relevant supporting documentation to satisfy the TPB that the course provider meets the conditions and standards detailed in this TPB(I). All requests should be sent to courseprovider@tpb.gov.au.

- All requests for approval as an approved course provider will be considered by the Board, or a Committee of the Board, on their merits.

- In considering a request for approval as an approved course provider, the TPB may be guided by reviews conducted by other relevant regulatory bodies in the education sector.