Download Information for clients Factsheet

- Introduction

- Background

- What are the obligations under section 45?

- Current and prospective clients

- Information about how to access and search the TPB’s Register

- Information about how to make a complaint to the TPB

- Information about rights, responsibilities and obligations

- Information about prescribed events

- Information about prescribed matters

- Other matters

- What are the manner, form and timeframe requirements for section 45?

- How to keep clients informed

- When to keep clients informed

- Case studies

- Case study 1 – tax agent fails to advise all current and prospective clients of a prescribed event which occurred after 1 July 2022 but before the relevant application date

- Case study 2 – prospective client engages a company tax agent who fails to advise of matters relating to the TPB

- Case study 3 – BAS agent re-engages a current client and advises of matters relating to the TPB

- Resources

Disclaimer

This is a Tax Practitioners Board (TPB) Information sheet (TPB(I)).

This document is intended as information only. It provides information regarding the TPB’s position on the application of section 45 of the Tax Agent Services (Code of Professional Conduct) Determination 2024 (Determination).

While this TPB(I) seeks to provide practical assistance and explanation, it does not exhaust, prescribe or limit the scope of the TPB’s powers in the Tax Agent Services Act 2009 (TASA). In addition, please note that the principles, explanations and examples in this TPB(I) do not constitute legal advice and do not create additional rights or legal obligations beyond those that are contained in the TASA or which may exist at law. Please refer to the TASA and the Determination for the precise content of the legislative requirements.

Document history

This TPB(I) was originally issued on 24 October 2024. The TPB invited comments and submissions in relation to the information contained in it by 21 November 2024. The TPB considered all the comments and submissions received and published the TPB(I) on 23 December 2024.

This TPB(I) is based on the TASA as at the date of issue.

Issued: 23 December 2024

Introduction

- This Information sheet (TPB(I)) has been prepared by the Tax Practitioners Board (TPB) to assist registered tax agents and BAS agents (collectively referred to as ‘registered tax practitioners’) to understand their obligations under section 45 of the Tax Agent Services (Code of Professional Conduct) Determination 2024 (Determination).

- While the focus of this TPB(I) is on the obligations in section 45 of the Determination, it is important to note there are also 17 obligations in the Code of Professional Conduct (Code),[1] additional obligations in the Determination, and further requirements that registered tax practitioners must comply with under the Tax Agent Services Act 2009 (TASA). These include ongoing requirements in relation to maintaining registration under the TASA, including that a registered tax practitioner is a ‘fit and proper’ person.[2]

- In this TPB(I), you will find the following information:

- Background to the legislative requirement (paragraphs 4 to 8),

- Details of the obligations under section 45 (paragraphs 9 to 42),

- Details of the manner, form and timeframe requirements under section 45 (paragraphs 43 to 50),

- Case studies (paragraph 51).

Background

- Section 30-10 of the TASA contains the Code, comprising 17 items which regulate the personal and professional conduct of all registered tax practitioners.

- One of these obligations is contained in subsection 30-10(17) of the TASA, which requires registered tax practitioners to comply with any obligations that the Minister determines, by legislative instrument, under section 30-12 of the TASA.

- On 1 July 2024, the Minister determined 8 additional Code obligations, set out in the Determination. These additional Code obligations apply from:

- The deferred application date provides registered tax practitioners time to understand their obligations, assess their own practice and implement changes, if required, to comply with their obligations under the Determination from the relevant application date under paragraph 6.

- For further information on the Determination, refer to the TPB’s website guidance titled The Code Determination – Background and context. This guidance provides additional background information including:

- the process to finalise the Determination

- commencement and application date

- the TPB’s approach to support implementation.

What are the obligations under section 45?

- Section 45 of the Determination requires registered tax practitioners to advise all current and prospective clients, in the prescribed manner, form and timeframes, of all of the following:

- that the TPB maintains a register of tax agents and BAS agents and how clients can access and search the register

- how clients can make a complaint about a tax agent service provided by a registered tax practitioner, including the complaints process of the TPB

- general information about:

- the registered tax practitioner’s rights, responsibilities and obligations as a registered tax practitioner, including to their client, under the taxation laws (including the TASA and Code)

- what obligations their clients have to their registered tax practitioner

- if any of the prescribed events in paragraph 45(1)(d) of the Determination have occurred within the last 5 years[5]

- if any of the prescribed matters in paragraph 45(1)(e) of the Determination currently apply to a registered tax practitioner[6].

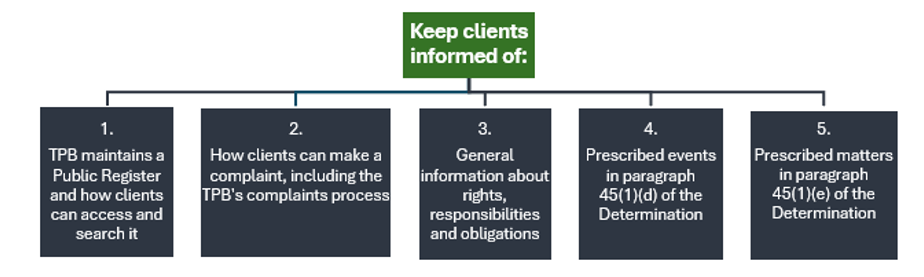

Figure 1 below provides a summary of the obligations under section 45 of the Determination.

Figure 1 – Summary of requirements of section 45 of the Determination

- These obligations highlight the importance of a registered tax practitioner’s role in representing the tax profession and preserving public trust and confidence in the tax system. It also further increases the transparency of the tax profession, which is critical to ensuring the integrity of the tax system as a whole.[7]

- Section 45 of the Determination ensures clients are provided with all the information that is reasonably relevant to them to make fully informed decisions as to whether to engage (or continue to engage) a registered tax practitioner to provide them with a tax agent service, and to ensure the trusted tax practitioner they engage to represent them, and to act on their behalf, to the Australian Taxation Office, is the right professional for the client.

- Where a partnership or company registered tax practitioner (the entity) provides tax agent services to its clients, the obligation under section 45 of the Determination is to be met by the entity. The obligation under section 45 does not extend to the individual registered tax practitioners who form part of the ‘sufficient number’ requirement for the entity and provide tax agent services on behalf of the entity. This is on the basis that, in the circumstances described above, the individual supervisory tax practitioners are not providing tax agent services to clients and prospective clients in their personal capacity. However, if an individual registered tax practitioner also provides tax agent services in their personal capacity (in addition to the tax agent services provided on behalf of the entity), the individual registered tax practitioner will be separately required to comply with the obligation under section 45 with respect to that personal capacity.

- It is important to note that while a company or partnership (the entity) is not required under section 45 of the Determination to advise its clients about relevant matters concerning individuals providing services on its behalf, the entity will still need to comply with its other obligations under the TASA, including the Code and Determination, such as ensuring that each individual registered tax practitioner providing tax agent services on the entity’s behalf is appropriately supervised, having regard to their knowledge and skills, the tax agent services being provided, and the entity’s system of quality management.[8]

- In addition, an individual registered tax practitioner who is required in their personal capacity under section 45 of the Determination to advise clients of relevant matters, should extend their disclosure to relevant matters relating to any company or partnership they are associated with and that are involved in the provision of tax agent services.[9]

- The key concepts of section 45 of the Determination are explained further below.

Current and prospective clients

- Registered tax practitioners must keep all current and prospective clients informed under section 45 of the Determination.

- Current clients include individuals and entities that have received, or are currently receiving, a tax agent service from a registered tax practitioner and remain engaged with the registered tax practitioner.

- On the other hand, prospective clients include individuals and entities that have directly contacted a registered tax practitioner about seeking an engagement for the provision of tax agent services, but are yet to engage the registered tax practitioner. This contact could include, for example, by email, phone or website. A prospective client also includes an individual or entity that has received a tax agent service previously from a registered tax practitioner, but it remains unclear whether the individual or entity intends to re-engage the registered tax practitioner.

- Prospective clients do not include individuals or entities making general enquiries about a registered tax practitioner, including in relation to information available on the registered tax practitioner’s website. For example, general enquiries may include those relating to pricing.

Information about how to access and search the TPB’s Register

- Registered tax practitioners must advise all current and prospective clients about:

- the TPB maintaining a register of tax agents and BAS agents, and

- how they can access and search that register.

- At a minimum, the TPB recommends registered tax practitioners provide the following information to all their current and prospective clients:

Information about how to make a complaint to the TPB

- Registered tax practitioners must advise all current and prospective clients of how the clients can make a complaint about a tax agent service they have received, including the complaints process of the TPB.

- Although a prospective client may be yet to receive a tax agent service from a registered tax practitioner, it is helpful to provide this information about the complaints process in advance, before the prospective client has received any tax agent services.

- At a minimum, the TPB recommends registered tax practitioners provide the following information to all their current and prospective clients:

- If the client wishes to make a complaint about a tax agent service that has been provided by the registered tax practitioner, a complaint can be made in writing to the TPB via its website and include a website link to the complaint form.[12]

- Further information on how to make a complaint to the TPB can be found on its website, including the TPB’s complaints process.[13]

Information about rights, responsibilities and obligations

- Under paragraph 45(1)(c) of the Determination, registered tax practitioners must advise all current and prospective clients of general information about:

- their rights, responsibilities and obligations as a registered tax practitioner, including to their client, under the taxation laws (including the TASA and Code), and

- what obligations their clients have to their registered tax practitioner.[14]

- General information about the rights, responsibilities and obligations of a registered tax practitioner includes, but is not limited to, information about obligations under the Code, such as acting lawfully in the client’s best interests, acting honestly and with integrity, having arrangements in place to manage any conflicts of interest, taking reasonable care to ensure the taxation laws are complied with, and providing services in a competent and timely manner.

- General information about a client’s obligations to their registered tax practitioner may include, but is not limited to:

- making all relevant information available to their registered tax practitioner in a complete and timely manner

- being truthful with the information provided to their registered tax practitioner

- advising of any changes in any matter that is relevant to the tax agent services that are to be provided by their registered tax practitioner

- keeping the required records and providing information to their registered tax practitioner on a timely basis

- being co-operative with their registered tax practitioner’s requests and meeting their due dates.

- The TPB’s factsheet titled 'Information for clients' contains some general information on the obligations of a registered tax practitioner and their client.[15] For further information on this factsheet and how it can assist registered tax practitioners to comply with their obligations under section 45 of the Determination, refer to paragraphs 47 to 48 below.

- Registered tax practitioners may enter into a contractual arrangement with their client (for example, via a letter of engagement) which sets out the rights, responsibilities and obligations of a registered tax practitioner and their client. Although the terms of the engagement is a matter for the registered practitioner and their client, it is important to note registered tax practitioners cannot contract out of their statutory obligations under the TASA, including the Code. For example, where a registered tax practitioner seeks an indemnity from their client in the event of a breach of the terms of a contract, this will not abrogate the registered tax practitioner’s obligations under the TASA.

Information about prescribed events

Paragraph 45(1)(d) of the Determination provides:

You[16] must advise all current and prospective clients, … if any of the following events have occurred within the last 5 years:

i. your registration was suspended or terminated by the Board

ii. you were an undischarged bankrupt or went into external administration[17]

iii. you were convicted of a serious taxation offence[18]

iv. you were convicted of an offence involving fraud or dishonesty[19]

v. you were serving, or were sentenced to, a term of imprisonment in Australia for 6 months or more[20]

vi. you were penalised, subject to an injunction, or been subject to an order for breaching a voluntary undertaking, for being a promoter of a tax exploitation scheme[21]

vii. you were penalised, subject to an injunction, or been subject to an order for breaching a voluntary undertaking, for implementing a scheme that has been promoted on the basis of conformity with a public ruling, private ruling or oral ruling in a way that is materially different from that described in the ruling[22]

viii. you were penalised, subject to an injunction, or been subject to an order for breaching a voluntary undertaking, for promoting on the basis of conformity with a public ruling, private ruling or oral ruling a scheme that is materially different from that described in the ruling

xi. the Federal Court has ordered you to pay a pecuniary penalty for contravening a civil penalty provision under the Act.[23]

- Most of the prescribed events listed above (that is, events (ii) to (vii)) are consistent with the events that may affect the continued registration of a registered tax practitioner, which must be notified to the TPB for consideration as part of the registered tax practitioner’s ongoing registration requirement to be a fit and proper person.[24] Even where a registered tax practitioner has complied with this requirement by notifying the TPB of an event and then found to continue to be a fit and proper person, the obligation under paragraph 45(1)(d) of the Determination still requires registered tax practitioners to take the additional step to separately advise their current and prospective clients of the prescribed event.

- When determining what events have occurred within the last 5 years, the look back period is to be calculated by reference to the time an inquiry to engage or re-engage is received by the registered tax practitioner from the client. However, the 5-year look back period does not apply to events which occurred before 1 July 2022.[25]

- Where disclosure is required, the TPB generally expects registered tax practitioners to provide a reasonable level of detail about the prescribed event so that clients are adequately informed of the matter(s). Information that may be disclosed to clients includes:

- the date the prescribed event occurred

- a description of the prescribed event

- a website link to the registered tax practitioner’s record on the TPB Register

- whether the prescribed event is ongoing or has been finalised

- how the registered tax practitioner intends to provide another update about the prescribed event (if applicable).

- Where relevant, registered tax practitioners should also consider making plans or arrangements while they are unable to run their practice in the short or long term to avoid any impact on their clients and the practice. For further guidance, refer to the TPB’s guidance on Incapacity of a tax practitioner.

- Where a registered tax practitioner is required to advise clients of a prescribed event and the registered tax practitioner has received legal advice about the event, it is not necessary for the registered tax practitioner to disclose the legal advice itself to clients or waive legal professional privilege (LPP).[26] LPP protects confidential communications between a lawyer and their client from compulsory production. Registered tax practitioners may wish to seek independent legal advice if they are unsure whether the disclosure of information is protected by LPP.

- Subject to the relevant application date outlined in paragraph 6 above, the obligation under paragraph 45(1)(d) of the Determination applies only in relation to events that have arisen on or after 1 July 2022.[27]

- For prescribed events which arose between 1 July 2022 and before the relevant application date of the obligation for the registered tax practitioner, disclosure to clients must be made within 30 days of the relevant application date under the transitional rule[28]. This is provided section 45 still requires a client to be advised of that information at that time.

- This means that disclosure of prescribed events to clients must be made no later than:[29]

- 31 July 2025 – for registered tax practitioners with 100 or less employees as at 31 July 2024

- 31 January 2025 – for any other registered tax practitioners.[30]

Information about prescribed matters

- Under paragraph 45(1)(e) of the Determination, registered tax practitioners are required to advise all current and prospective clients if the registered tax practitioner’s registration is subject to conditions.[31]

- A ‘condition’ acts to limit the scope of services that can be provided by a registered tax practitioner. Examples of conditions imposed by the TPB are listed on the TPB’s website and include tax (financial) advice services, indirect taxes, quantity surveying, research and development and superannuation.

Other matters

- There may be other matters for which a registered tax practitioner will need to advise their clients under other laws. For example, where a registered tax practitioner has failed to comply with the Code and they have been ordered by the TPB under section 30-20 of the TASA to take specific action(s). This may include an order requiring a registered tax practitioner to advise their clients of one or more matters, such as the findings of the TPB’s investigation specified in the order.[32] Further, in certain situations, a failure to disclose information relevant to a decision to procure services, even if known only to the supplier of those services, can be unlawful under Australian Consumer Law.[33]

What are the manner, form and timeframe requirements for section 45?

- Where registered tax practitioners are required to advise their current and prospective clients of information covered by subsection 45(1) of the Determination, it must be done in the prescribed manner, form and timeframes set out in subsection 45(2) of the Determination. This is explained further below.

How to keep clients informed

- Registered tax practitioners must give the information set out in subsection 45(1) of the Determination, in writing, to all their current and prospective clients in a prominent, clear and unambiguous way. While the phrase ‘prominent, clear and unambiguous way’ is not defined in the TASA, it is generally taken to mean that information is explained in simple, plain English which allows clients to make informed decisions as to whether to engage (or continue to engage) a registered tax practitioner to provide them with a tax agent service.[34] This requirement is intended to provide flexibility to registered tax practitioners as to the system they use to advise their clients.

- One example of a registered tax practitioner who will be taken to have given information to all their current and prospective clients as required under subsection 45(2) of the Determination is where the registered tax practitioner:[35]

- publishes the information on a publicly accessible website that the registered tax practitioner uses to promote the tax agent services they offer

- includes the information in letters of engagement or re-engagement (as the case requires), given to each of their clients,[36] and

- provides their clients, upon engagement or re-engagement (as the case requires), with a copy of the TPB’s factsheet on general information for clients.[37]

- It is noted the example in the paragraph above is not the only way in which a registered tax practitioner can satisfy subsection 45(2) of the Determination. For example, where a registered tax practitioner does not have a publicly accessible website to promote tax agent services, the registered tax practitioner may satisfy the requirements of subsection 45(2) by simply undertaking the steps in paragraphs 45(b) and (c) above.

- Registered tax practitioners may wish to use the TPB’s factsheet with their current and prospective clients. This outlines the relevant information to satisfy the requirements of paragraphs 45(1)(a) and (b) of the Determination regarding information about the Register and complaints process.[38]

- The factsheet will also assist registered tax practitioners to satisfy part of the requirements of paragraph 45(1)(c) regarding the rights, responsibilities and obligations of the registered tax practitioner and their client. However, the factsheet will need to be supplemented with additional relevant information pertaining to the terms of engagement via a letter of engagement or some other communication, noting the terms of engagement will vary based on each individual engagement.

When to keep clients informed

- The required timeframes for registered tax practitioners to keep all their current and prospective clients informed are outlined in the table below. The TPB generally expects that registered tax practitioners would take all reasonable steps to advise their clients of relevant matters as soon as practicable.

| No. | |

|---|---|

| 1 | |

| Relevant matters | The TPB maintains a register of tax agents and BAS agents and how clients can access and search the register. |

| Required timeframes for tax practitioners to advise clients | Registered tax practitioners must advise clients upon:

|

| 2 | |

| Relevant matters | How clients can make a complaint about a tax agent service they have received, including the complaints process of the TPB. |

| Required timeframes for tax practitioners to advise clients | Registered tax practitioners must advise clients upon:

|

| 3 | |

| Relevant matters | General information about rights, responsibilities and obligations |

| Required timeframes for tax practitioners to advise clients | Registered tax practitioners must advise clients upon:

|

| 4 | |

| Relevant matters | Prescribed events in paragraph 45(1)(d) of the Determination which arose between 1 July 2022 and the relevant application date for the registered tax practitioner[42] |

| Required timeframes for tax practitioners to advise clients | Registered tax practitioners must advise clients of prescribed events by no later than:

|

| 5 | |

| Relevant matters | Prescribed events in paragraph 45(1)(d) of the Determination which arose on or after the relevant application date for the registered tax practitioner[43] |

| Required timeframes for tax practitioners to advise clients |

|

| 6 | |

| Relevant matters | Prescribed matters in paragraph 45(1)(e) of the Determination[44] |

| Required timeframes for tax practitioners to advise clients |

|

| No. | Relevant matters | Required timeframes for tax practitioners to advise clients |

|---|---|---|

| 1 | The TPB maintains a register of tax agents and BAS agents and how clients can access and search the register. | Registered tax practitioners must advise clients upon:

|

| 2 | How clients can make a complaint about a tax agent service they have received, including the complaints process of the TPB. | Registered tax practitioners must advise clients upon:

|

| 3 | General information about rights, responsibilities and obligations | Registered tax practitioners must advise clients upon:

|

| 4 | Prescribed events in paragraph 45(1)(d) of the Determination which arose between 1 July 2022 and the relevant application date for the registered tax practitioner[42] | Registered tax practitioners must advise clients of prescribed events by no later than:

|

| 5 | Prescribed events in paragraph 45(1)(d) of the Determination which arose on or after the relevant application date for the registered tax practitioner[43] |

|

| 6 | Prescribed matters in paragraph 45(1)(e) of the Determination[44] |

|

Case studies

- These case studies provide general guidance only. In all cases, consideration will need to be given to the specific facts and circumstances.

Case study 1 – tax agent fails to advise all current and prospective clients of a prescribed event which occurred after 1 July 2022 but before the relevant application date

Situation

Eric is a registered tax agent, operating as sole practitioner with no employees.

In early 2023, Eric was subject to an investigation by the TPB into his alleged breach of Code item 7 (for failing to ensure that a tax agent service that he provided was provided competently). Following the investigation, the TPB found Eric had breached Code item 7 and decided to suspend Eric’s registration for 6 months.

On 1 June 2023, Eric received correspondence from the TPB notifying of the decision to suspend his registration. As such, Eric was prohibited from providing tax agent services for a fee to his clients during the suspension period. This sanction was also published on the TPB Register.

As the suspension is a prescribed event under subparagraph 45(1)(d)(i) of the Determination and it arose after 1 July 2022 but before the relevant application date applicable to Eric (i.e. 1 July 2025), Eric is required to clearly inform all current and prospective clients of this relevant matter (being the suspension) no later than 30 days after section 45 of the Determination began to apply to him. Therefore, this notification to clients must be made by 31 July 2025. This information should inform clients that the TPB had previously sanctioned Eric on 1 June 2023 for a breach of Code item 7 by suspending his registration for 6 months.

However, Eric chooses to conceal his prior suspension from his clients and therefore does not inform his clients of this information within the required 30-day timeframe.

Is there a breach of subsection 45(1) of the Determination?

Eric has failed to comply with subsection 45(1) of the Determination and as a result, he has breached subsection 30-10(17) of the TASA, for failing to keep his clients informed of a prescribed event. Depending on the circumstances, the TPB may also find Eric has breached other obligations under the Code and/or is not a fit and proper person to be registered as a tax agent.

Case study 2 – prospective client engages a company tax agent who fails to advise of matters relating to the TPB

Situation

CTX Pty Ltd is a registered company tax agent with 200 employees.

CTX Pty Ltd is engaged by a prospective client and provides a letter of engagement to the client which sets out a description of the work to be performed. However, the company omits information about:

- information about the TPB maintaining a register of tax agents and BAS agents and how the client can access and search the register, and

- how the client can make a complaint about a tax agent service the company provides, including the TPB’s complaints process.

Additionally, CTX Pty Ltd did not take any steps to include this information on the company’s publicly accessible website.

Is there a breach of subsection 45(1) of the Determination?

CTX Pty Ltd has failed to comply with subsection 45(1) of the Determination and as a result, the company has breached subsection 30-10(17) of the TASA, for failing to keep its client informed of matters relating to the TPB at the time of engagement.

Case study 3 – BAS agent re-engages a current client and advises of matters relating to the TPB

Situation

Robyn is a registered BAS agent, operating as a sole practitioner with no employees.

Robyn engages a new client and provides a letter of engagement to the client. The letter contains detailed information about, among other things, the TPB’s Register, how to make a complaint to the TPB, including the TPB’s complaints process, and general information about the rights, responsibilities and obligations of Robyn as the registered BAS agent and the client. Robyn’s practice does not have a publicly accessible website.

In the following year, the client expressed interest in continuing the engagement of services. Robyn reviews and re-confirms the arrangement with the client with a new letter of engagement, which again attaches additional information about the TPB’s Register, complaints process and general information about rights, responsibilities and obligations.

Is there a breach of subsection 45(1) of the Determination?

Robyn has complied with her obligations under section 45 of the Determination.

Resources

[1] The provisions of the Code are contained in section 30-10 of the TASA. The TPB has also published an explanatory paper that sets out its views on the application of the Code. Refer to TPB Explanatory paper TPB(EP) 01/2010 Code of Professional Conduct.

[2] For further information, see TPB Explanatory paper TPB (EP) 02/2010 Fit and proper person.

[3] This includes new registered tax practitioners with 100 or less employees that register between 1 August 2024 and 30 June 2025 inclusive.

[4] See the Tax Agent Services (Code of Professional Conduct) Amendment (Measures No. 1) Determination 2024.

[5] For more information on prescribed events in paragraph 45(1)(d) of the Determination, refer to paragraphs 31 to 39 of this TPB(I).

[6] For more information on prescribed matters in paragraph 45(1)(e) of the Determination, refer to paragraphs 40 to 41 of this TPB(I).

[7] See the Explanatory Statement to the Tax Agent Services (Code of Professional Conduct) Determination 2024.

[8] For further information, refer to the guidance provided in the TPB Information sheet TPB(I) 48/2024 Supervision, competency and quality management under the Tax Agent Services Act 2009.

[9] See Explanatory Statement to the Tax Agent Services (Code of Professional Conduct) Amendment (Measures No. 2) Determination 2024.

[12] See the TPB complaint form.

[13] See Complaints.

[14] See also (if applicable) guidance in paragraphs 3.17 and 3.18 of APES 220 Taxation Services.

[15] This factsheet may be downloaded from the TPB’s website.

[16] The references to ‘you’ are referring to registered tax practitioners.

[17] An individual was an ‘undischarged bankrupt’ if they have been declared bankrupt under the Bankruptcy Act 1966 and have not been discharged from the bankruptcy. A company went into ‘external administration’ if it goes into external administration as defined in the Corporations Act 2001. This generally means that its directors are required to relinquish direction of its affairs to a receiver, administrator, provisional liquidator or liquidator.

[18] A ‘serious taxation offence’ is, in brief, one of a number of offences specified in the Criminal Code (if it relates to a tax liability) or a taxation offence that is punishable by a fine exceeding 40 penalty units or imprisonment (or both).

[19] The term an ‘offence involving fraud or dishonesty’ takes its ordinary meaning and is determined by reference to community standards. For example, the Criminal Code (which is an Act or legislation of Parliament) defines ‘dishonest’ as dishonest according to the standards of ordinary people in circumstances where the defendant is aware of these standards.

[20] An individual is ‘sentenced to a term of imprisonment’ if a sentence is imposed on the individual and that sentence includes a term of imprisonment. To be ‘sentenced’ to a term of imprisonment, an individual need not have actually served any part of the term of imprisonment, provided that a court has imposed a sentence on the individual.

[21] An individual is considered to have been ‘penalised for being a promoter of a tax exploitation scheme’ if they have been ordered to pay a civil penalty for engaging in conduct that results in the entity (or another entity) being a promoter of a tax exploitation scheme as defined in Division 290 of Schedule 1 to the Taxation Administration Act 1953.

[22] An individual is considered to have been ‘penalised for implementing a scheme’ within the terms in section 20-45 of the TASA if they have been ordered to pay a civil penalty for engaging in such conduct as defined in Division 290 of Schedule 1 to the Taxation Administration Act 1953.

[23] The reference to ‘the Act’ is referring to the Tax Agent Services Act 2009.

[24] See sections 20-15, 20-45 and 30-35 of the TASA.

[25] See subsection 151(1) of the Determination.

[26] Section 70-50 of the TASA provides that the TASA does not affect the law relating to LPP.

[27] See subsection 151(1) of the Determination.

[28] See subsection 100(1) of the Determination.

[29] See subsection 151(2) of the Determination.

[30] For further information, refer to paragraph 49 of this TPB(I).

[31] The TPB Register provides a current record of any conditions imposed on the registration of a registered tax practitioner.

[32] See paragraph 30-20(1)(d) of the TASA.

[33] See Explanatory Statement to the Tax Agent Services (Code of Professional Conduct) Amendment (Measures No. 2) Determination 2024.

[34] Similarly, Australian financial services licensees and authorised representatives that provide financial product advice to retail clients, are required to disclose information contained in a Statement of Advice in a clear, concise and effective manner. See the Australian Securities & Investments Commission Regulatory Guide 175 AFS licensing: Financial product advisers—Conduct and disclosure.

[35] See example provided in subsection 45(2) of the Determination.

[36] For further information, refer to the TPB Practice note TPB(PN) 3/2019 Letters of engagement.

[37] The TPB’s factsheet titled ‘Information for clients’ may be downloaded from the TPB’s website.

[38] The TPB’s factsheet on general information for clients may be attached to letters of engagement or re-engagement with your clients.

[39] A client does not specifically need to ask about the TPB Register or the complaints process to make a relevant request. For example, a relevant request could be if the client asks what they can do if they are not happy with a tax agent service provided, or how they can know if a tax agent is registered or not.

[40] See footnote 39 above.

[41] See footnote 39 above.

[42] For further information regarding the ‘application date’, see paragraph 6 of this TPB(I).

[43] See footnote 5 above.

[44] See footnote 6 above