Tax Practitioners Board exposure draft

The Tax Practitioners Board (TPB) has released this draft Information Sheet (TPB(I) D54/2024) as an exposure draft and invites comments and submissions in relation to the information contained in it. The closing date for submissions was previously 24 September 2024, this date has now been extended with a new closing date to be advised. The TPB will then consider any submissions before settling its position, undertaking any further consultation required and finalising the TPB(I).

Written submissions should be made via email at tpbsubmissions@tpb.gov.au or by mail to:

Tax Practitioners Board

GPO Box 1620

SYDNEY NSW 2001.

Disclaimer

This document is in draft form, and when finalised, will be intended as information only. It provides information regarding the TPB’s position on the application of section 15 of the Tax Agent Services (Code of Professional Conduct) Determination 2024.

While this draft TPB(I) seeks to provide practical assistance and explanation, it does not exhaust, prescribe or limit the scope of the TPB’s powers in the Tax Agent Services Act 2009 (TASA). In addition, please note that the principles, explanations and examples in this draft TPB(I) do not constitute legal advice and do not create additional rights or legal obligations beyond those that are contained in the TASA or which may exist at law. Please refer to the TASA and the Determination for the precise content of the legislative requirements.

Document history

This draft TPB(I) was issued on 6 August 2024 and is based on the TASA as at the date of issue.

Issued: 6 August 2024

Introduction

- This draft Information sheet (draft TPB(I)) has been prepared by the Tax Practitioners Board (TPB) to assist registered tax and BAS agents (collectively referred to as ‘registered tax practitioners’) to understand their obligations under section 15 of the Tax Agent Services (Code of Professional Conduct) Determination 2024 (Determination) and section 50-20 of the Tax Agent Services Act 2009 (TASA).

- While the focus of this draft TPB(I) is on the obligations in section 15 of the Determination, it is important to note that there are also 17 obligations in the Code of Professional Conduct (Code),[1] additional obligations in the Determination, and further requirements that registered tax practitioners must comply with under the TASA. These include ongoing requirements in relation to maintaining registration under the TASA, including that a registered tax practitioner is a ‘fit and proper’ person.[2]

- The obligations seek to outline the high professional and ethical standards expected by the community of registered tax practitioners, with the objective of:

- improving transparency and accountability

- giving the public greater confidence and trust in the integrity of the tax profession

- strengthening the regulatory framework and the regulation of the tax profession.

- In addition to the draft guidance on the obligations in section 15 of the Determination, this draft TPB(I) also contains a number of consultation questions at paragraph 62, which may assist you in providing feedback. The TPB welcomes submissions in response to the consultation questions, and any other aspect of this draft TPB(I).

- In this TPB(I), you will find information on:

- Background to the legislative requirements (paragraphs 6 - 12)

- Making or preparing (or permitting or directing another to make or prepare) false or misleading statements to the TPB or Commissioner (paragraphs 13 - 27)

- Correcting a false or misleading statement made to the TPB or Commissioner (paragraphs 28 - 41)

- Statements made to other Australian government agencies (paragraphs 42 - 44)

- Breach reporting obligations for registered tax practitioners (paragraphs 45 and 46)

- Application of the requirements under section 15 of the Determination (paragraph 47)

- Civil penalties and criminal liability for making false and misleading statements (paragraphs 48 to 54)

- Consequences for failing to comply under the TASA (paragraphs 55 to 59)

- Case studies (paragraph 60)

- Further information (paragraph 61)

- Consultation questions (paragraph 62).

Background

- Section 30-10 of the TASA contains the Code, comprising of 17 obligations which regulate the personal and professional conduct of all registered tax practitioners.

- One of these obligations is contained in subsection 30-10(17) of the TASA, which requires registered tax practitioners to comply with any obligations that the Minister determines, by legislative instrument, under section 30-12 of the TASA.

- The Australian Government recognises the vital role that registered tax practitioners play in the tax system. The government has determined that enhancement to the TASA legislative framework is required to ensure the TPB can uphold the appropriate standards of professional and ethical conduct in the profession.

- Accordingly, on 1 July 2024, the Minister determined 8 additional Code obligations, set out in the Determination, under section 30-10 of the TASA. These additional Code obligations commenced on 1 August 2024. However, the Minister has announced that the government will introduce a transitional rule that will provide registered tax practitioners until the following date to bring themselves into compliance with these new obligations.

- 1 January 2025 – for registered tax practitioners with more than 100 employees

- 1 July 2025 – for registered tax practitioners with 100 or less employees.

- This transitional rule will apply so long as registered tax practitioners continue to take genuine steps towards compliance during this period.

- This draft TPB(I) deals with one of these additional obligations under the Determination in relation to false or misleading statements. It also includes relevant guidance for registered tax practitioners regarding other false and misleading statement requirements under the TASA.

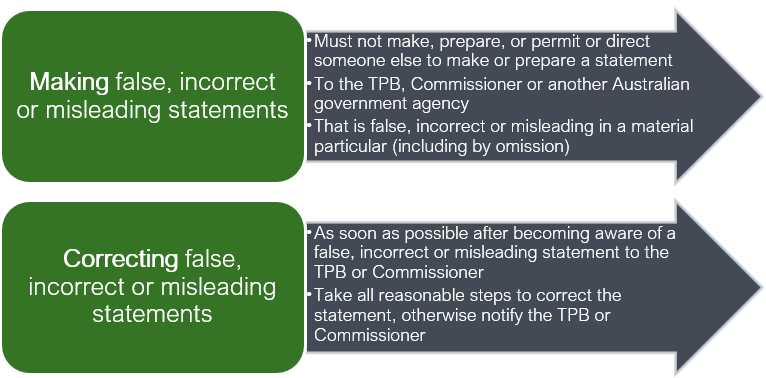

- The obligations in relation to false or misleading statements under the Determination has 2 aspects, requiring registered tax practitioners to:

not make or prepare, or permit or direct someone else to make or prepare, false, incorrect or misleading statements to:

i) the TPB

ii) the Commissioner of Taxation (Commissioner) or

iii) another Australian government agency

- in relation to statements to the TPB or Commissioner, correct any statement given that is false, incorrect or misleading (or where a tax practitioner prepared the statement or permitted or directed someone else to prepare the statement, advise the maker of the statement that the statement should be corrected, otherwise notify the TPB or Commissioner).

Figure 1: Summary of requirements of section 15 of the Determination

Making or preparing (or permitting or directing another to make or prepare) false, incorrect or misleading statements

- Subsection 15(1) of the Determination provides that registered tax practitioners must not:

- make a statement to the TPB or the Commissioner, or

- prepare a statement that they know, or ought reasonably to know, is likely to be made to the TPB or Commissioner by an entity, or

permit or direct someone else to make or prepare such a statement,

that the registered tax practitioner knows, or ought reasonably to know:

- is false, incorrect or misleading in a material particular, or

omits any matter or thing without which the statement is misleading in a material respect,

in their capacity as a registered tax practitioner or in any other capacity.

- The nature of this obligation is one of truthfulness and integrity.[3]The provision is concerned with particulars that are material in nature. This means that false or misleading particulars that are trivial in the circumstances will not constitute a breach of section 15 of the Determination.[4]

- Expanding this obligation to include statements made in a registered tax practitioner’s personal and professional activities highlights the important role they play in representing the tax profession and preserving public confidence in the tax system, particularly when making representations to the TPB or Commissioner for their own or their clients’ tax affairs.[5]

- The key elements of the obligations under section 15 of the Determination are explained further below.

‘Statement to the TPB or Commissioner’

- Consistent with the concept of a ‘false or misleading statement’ in respect of the administration of penalties by the Commissioner under the Taxation Administration Act 1953 (TAA),[6]a statement for the purposes of the TASA is anything that is disclosed for a purpose connected with a taxation law orally or in writing (and includes those made electronically). A statement includes the following:

- statements prepared for, or made in, correspondence, a registration and/or application form, any taxation document,[7] an activity statement, an amendment request or any other communication

- statements made by omission, if an entity fails to include material information in a document that requires that information to be supplied.

- Where a tax practitioner lodges a form, the form itself is not the statement that is prepared or made. The statement is the information at the individual labels, fields or questions, schedules or annexures. This means more than one statement can be prepared for, or made on, a form. Further, a statement prepared for or provided to the Commissioner includes a statement provided to the Australian Taxation Office (ATO).

- In addition to statements prepared for or made to the Commissioner, subsection 15(1) of the Determination also captures statements prepared for or made to the TPB. This could include statements prepared for or made to the TPB:

- under the notification requirements contained in sections 30-35 and 30-40 of the TASA[8]

- in response to formal and informal information requests made by the TPB

- by tax practitioners through MyProfile, for instance, in providing information relevant to a tax practitioner’s registration that may or may not be published on the TPB’s Public Register

- in any other communication.

- The statement to the TPB or Commissioner will also be caught if a registered tax practitioner permits or directs someone else to make or prepare such a statement. This could include, for example:

- statements that a registered tax practitioner permits to be made by individuals working under the supervision and control of the registered tax practitioner

- statements that a registered tax practitioner directs another individual (such as another tax practitioner, a client, employee or any other person) to make.

‘Know or ought reasonably to know’

- The phrase 'know or ought reasonably to know’ has two elements. The term “know” refers to actual knowledge. The phrase “ought reasonably to know” extends to ‘constructive knowledge’, where a person is taken to have knowledge about a matter, if the existence of that matter could be discovered by a reasonable person in the same position as the person, making reasonable enquiries.

- A registered tax practitioner must therefore take reasonable steps and make reasonable enquiries to ensure that a statement being prepared for, or made to, the TPB or Commissioner, or that the registered tax practitioner is permitting or directing to be made or prepared by someone else to the TPB or Commissioner, is not false, incorrect, or misleading in a material particular.

- It will generally be expected that a registered tax practitioner has a complete and comprehensive understanding of matters that relate to their own (personal) affairs and those in their professional capacity, when preparing or making statements to the TPB or Commissioner, or permitting or directing someone else to prepare or make statements to the TPB or Commissioner.

- The relevant factors in determining whether a registered tax practitioner ought reasonably to know that a statement they have made or been involved in the preparation of is false, incorrect or misleading will generally be consistent with the principles in the Code item under subsection 30-10(9) of the TASA, relating to taking reasonable care to ascertain a client’s state of affairs. [9] However, what is relevant in any given scenario will always depend on the circumstances and must be considered on a case-by-case basis.

- The extent to which a registered tax practitioner should make reasonable enquiries or take reasonable steps to substantiate information or statements it is preparing for or making to the TPB or Commissioner, or permitting or directing someone else to prepare for or make to the TPB or Commissioner, will be proportionate to the materiality of the matter that the statement or information is relating to. This will require the registered tax practitioner to use their professional judgement, having regard to the circumstances, including the following factors:

- whether the statement relates to satisfying a legal obligation, for example, meeting the tax practitioner registration requirements or satisfying other obligations under the Code and the TASA or other taxation laws

- if the statement is based on information provided by a third party, how familiar the registered tax practitioner is with the third party, and whether the third party is a credible source of information

- if the statement is based on information provided by a third party, whether the information is consistent with previous information provided by that third party

- the ability of the information or statement to be verified by an independent source

- the consequences for the registered tax practitioner, third party (if relevant), TPB, Commissioner, and tax system more generally, if the statement being made is incorrect.

‘False, incorrect or misleading in a material particular’

Registered tax practitioners are required to ensure that statements that they make to, or prepare for, the TPB or Commissioner, or that they permit or direct to be made to, or prepared for, the TPB or Commissioner, are not false or misleading in a material particular. The concepts of ‘false statements’, ‘incorrect statements’, ‘misleading statements’ and ‘material particulars’ are further explained below.

False statements

- a statement is false if it is contrary to fact or wrong

- a statement may be false because of something contained in the statement or because something is omitted from the statement

- if a statement was correct at the time it was made but is subsequently made incorrect because of a retrospective amendment to the law, it is not later considered false (or misleading).

Incorrect statements

- a statement is incorrect if it is not in accordance with fact, or is wrong.

Misleading statements

- a statement is misleading if it creates a false impression, even if it is literally true

- it may be misleading because of something contained in the statement or because of something omitted from the statement

- the reason the statement is misleading may be because it is uninformative, unclear or deceptive.

In a material particular

- whether a particular is ‘material’ will depend on the circumstances but generally speaking, a material particular is something that is likely to be relevant to an entity's obligations or entitlements under the TASA or taxation law more generally

- an inconsequential statement which is minor in nature and does not affect an entity's legal obligations or entitlements will generally not be a material particular for the purposes of section 15 of the Determination

- materiality is determined at the time the statement is made - a statement cannot be made material because of subsequent events

- however, materiality may be unknown until a subsequent event occurs or further evidence comes to light which reveals that the statement was false or misleading in a material particular at the time it was made. In such a case, registered tax practitioners are required to correct the false or misleading statement (refer to paragraphs 28 to 34 below).

Omits any matter or thing without which the statement is misleading in a material respect

- The obligation in section 15 of the Determination extends to the omission of any matter or thing without which the statement is misleading in a material respect. Whether or not the omission of a matter results in a statement being misleading in a material respect will depend on the circumstances including consideration of whether the statement is likely to be relevant to an entity’s obligations or entitlements under the TASA or taxation law more generally.

Correcting a false, incorrect or misleading statement to the TPB or Commissioner

- Subsection 15(2) of the Determination requires registered tax practitioners, as soon as possible after the registered tax practitioner becomes aware that a statement given to the TPB or Commissioner was false, incorrect or misleading in a material particular (at the time that it was made), or omitted any matter or thing without which the statement is misleading in a material respect, to take all reasonable steps to:

- where the statement was made by the registered tax practitioner (or the registered tax practitioner permitted or directed someone else to the make the statement) – correct the statement

- where the registered tax practitioner prepared the statement (or permitted or directed someone else to prepare the statement) – advise the maker of the statement that the statement should be corrected

- where the registered tax practitioner prepared the statement and the maker does not correct the statement within a reasonable time – notify the TPB or Commissioner that the statement is false, incorrect or misleading in a material particular, or omits a matter or thing without which the statement is misleading in a material respect.

- It is important to note that the requirement to correct the statement applies as soon as possible after registered tax practitioners become aware of the false, incorrect or misleading statement. The meaning of ‘as soon as possible’ will depend on the circumstances, as explained in paragraph 37 below.

- For the purposes of these obligations, the ‘maker’ of a statement refers to the person who made or is making the statement in question, whether they make the statement themselves or permit or direct another person to make it on their behalf.

- The ‘preparer’ of a statement refers to a person who is preparing the statement on behalf of the statement maker or directing or permitting someone to prepare the statement on behalf of the statement maker. In some cases, the ‘preparer’ may be the same person as the ‘maker’.

- Registered tax practitioners will be required to take reasonable steps to correct false, incorrect or misleading statements under these obligations when they are the ‘maker’ of the statement in question, or when they are the ‘preparer’ of the statement (including if they permitted or directed someone else to be the preparer of the statement).

- While subsection 15(2) does not require registered tax practitioners to take action in relation to a statement that was not false, incorrect or misleading at time it was made, but later becomes false, incorrect or misleading because of some later event, registered tax practitioners must ensure that subsequent statements made to the TPB or Commissioner are not false, incorrect or misleading in a material particular, and must comply with all other obligations under the TASA, for example, the requirement to notify the TPB about changes in circumstances[10] and breach reporting.[11]

- The requirement to correct encourages registered tax practitioners to be accountable and make corrections to ensure the TPB and Commissioner have access to the most accurate information. Correcting information also displays the goodwill of the registered tax practitioner and may be factored into any potential sanctions pursued by the TPB for breach of the Code.

Advising the maker of a false, incorrect or misleading statement that the statement should be corrected

- Where a registered tax practitioner has become aware that a statement they prepared (or permitted or directed someone else to prepare) is false, incorrect or misleading in a material particular or omitted any matter or thing without which the statement is misleading in a material respect, the registered tax practitioner must take reasonable steps to advise the maker of the statement that the statement should be corrected. If, given the nature of the registered tax practitioner’s relationship with the maker of the statement, the registered tax practitioner advises the maker of the statement that the statement should be corrected verbally, it is recommended that the registered tax practitioner confirms the advice provided in writing (for example, through email or letter).

- When advising the maker of a false, incorrect or misleading statement that the statement should be corrected, registered tax practitioners should ensure that they advise the maker of the statement that the statement should be corrected as soon as possible. In some circumstances, there may be legal time limits that apply to making corrections. For example, under various tax laws, there are time limits that apply for correcting statements made in:

- business tax assessments

- activity statements

- PAYG (pas as you go) withholding payment summaries

- fringe benefits tax returns.

- Registered tax practitioners may also wish to advise the maker of a false, incorrect or misleading statement that should the maker of the statement not correct it within a reasonable period, the registered tax practitioner will be required to notify the TPB or Commissioner (whichever is relevant) that the statement is false, incorrect or misleading in a material particular, or omits a matter or thing without which the statement is misleading in a material respect. The TPB recommends that in providing this advice to the maker of the statement, the registered tax practitioner should also advise the maker of the statement the timeframe the registered tax practitioner considers to be reasonable for the statement to be corrected, having regard to a range of factors, including for example:

- the type of statement and the extent to which it is false, incorrect or misleading in a material particular or omits a matter or thing without which the statement is misleading in a material respect

- the consequences to the maker, third parties and/or the TPB or Commissioner, for the statement being false, incorrect or misleading in a material respect

- any legal or administrative timeframes that apply to the statement and the correction of the statement

- other evidence or information that the maker of the statement will need to obtain to correct the statement.

- For advice provided to clients in respect of correcting false, incorrect or misleading statements, registered tax practitioners should also be aware of their other obligations under the Code, including for example, Code item 12 (advising clients about their rights and obligations under the taxation laws that are materially related to the tax agent services provided), and Code item 7 (providing tax agent services to a competent standard).

Notifying the TPB or Commissioner when the maker of a false, incorrect or misleading statement does not correct it within a reasonable time

- The requirement to notify the TPB or Commissioner when the maker of a false, incorrect or misleading statement does not correct the statement within a reasonable time, is representative of the important role that registered tax practitioners play in the overall trust and confidence that the public places in the tax profession and tax system. Consistent with the obligation in Code item 4, which requires registered tax practitioners to act lawfully in the best interests of their clients, it is recognised that in some circumstances there may be a tension between acting in accordance with a client’s instructions and/or interests, and the registered tax practitioner’s own legal and ethical obligations. In these circumstances, registered tax practitioners are required to uphold their own legal and ethical obligations, even if doing so is contrary to their clients’ wishes or interests. This obligation will apply regardless of whether a client or former client permits or consents to the registered tax practitioner notifying the TPB or Commissioner about the false, incorrect or misleading statement.

- While registered tax practitioners involved in the preparation of a false, incorrect or misleading statement are required to notify the TPB or Commissioner, they are not obliged to correct the false, incorrect or misleading statement. In order to satisfy this requirement, registered tax practitioners must provide the TPB or the Commissioner with sufficient detail to identify the relevant statement and why the registered tax practitioner believes it to be false, incorrect or misleading in a material particular. The obligation does not require the registered tax practitioner to provide additional information, evidence or details in order for the statement to be corrected.

- Further, registered tax practitioners notifying the TPB or Commissioner that a statement previously provided to the TPB or Commissioner is false, incorrect or misleading in a material particular will not be in contravention of the confidentiality requirements in Code item 6 under subsection 30-10(6) of the TASA[12] because registered tax practitioners have a legal duty to correct such statements under subsection 15(2) of the Determination.

Statements made to other Australian government agencies

- Subsection 15(3) of the Determination extends similar obligations under subsection 15(1) in relation to making or preparing, or permitting or directing someone else to make or prepare, false, incorrect or misleading statements to other Australian government agencies.

- This obligation applies to statements made or prepared by a registered tax practitioner in any capacity.

- ‘Australian government agency’ is defined in section 995-1 of the Income Tax Assessment Act 1997 as the Commonwealth, State or Territory, or an authority of the Commonwealth, State or Territory. They include the Australian Securities and Investments Commission, Department of the Treasury and the Australian Competition and Consumer Commission.

Breach reporting obligations for registered tax practitioners

- In some circumstances, the making, preparing or directing, or permitting someone to make or prepare a false, incorrect or misleading statement may give rise to the registered tax practitioner having a reasonable belief that they have committed a ‘significant breach’ of the Code, requiring a report to be made to the TPB under the breach reporting requirements in the TASA. Further information on the breach reporting requirements, including how to lodge a report, can be found at tpb.gov.au/breach-reporting.

- While the TPB’s consideration and treatment of breaches of the TASA and Code ultimately depend on the facts and circumstances, the TPB will take into account mitigating circumstances, for example, compliance with the obligations relating to correcting false, incorrect or misleading statements and the breach reporting obligations, when considering the appropriate course of action (including the imposition of sanctions) in respect of a breach by a registered tax practitioner.

Application of the requirements under section 15 of the Determination

- Subject to the transitional arrangements in paragraph 9, the obligations in section 15 of the Determination only apply to statements made on or after 1 August 2024. They do not apply to any statement made, prepared or permitted or directed to be made or prepared before 1 August 2024. This means that the obligation to correct the statement, advise the maker of the statement to correct it, and notify the TPB or Commissioner about the statement also only arises if the statement was made on or after 1 August 2024. Notwithstanding this, other existing obligations under the TASA may still apply.

Civil penalties and criminal liability for making false or misleading statements

- In addition to the requirements contained in section 15 of the Determination, registered tax practitioners may also be subject to civil penalties and criminal liability for making, preparing or permitting or directing the making or preparing of false or misleading statements to the Commissioner.

Civil penalty liability under the TASA

- Section 50-20 of the TASA prohibits registered tax practitioners from knowingly or recklessly (by inclusion or omission):

- making a false or misleading statement to the Commissioner

- preparing a false or misleading statement which the registered tax practitioner knows, or ought reasonably to know is likely to be made to the Commissioner

- permitting or directing an entity to make or prepare a false or misleading statement to the Commissioner.

Criminal liability under sections 8K and 8N of the TAA

- Section 8K of the TAA makes it an offence for a person to make a statement that is false or misleading in a material particular to a taxation officer, including where the statement is misleading in a material particular due to an omission. In the prosecution of an entity for an offence under section 8K of the TAA, it is a defence if the entity proves that they did not know and could not reasonably be expected to have known that the statement was false or misleading.[13]

- Section 8N of the TAA makes it an offence for a person to recklessly make a statement that is false or misleading in a material particular to a taxation officer, including where the statement is misleading in a material particular due to an omission.

- These offences are of ‘absolute liability’[14]. The penalties imposed for offences under section 8K and 8N are set out in sections 8M and 8R of the TAA and will depend on the type of registered tax practitioner entity that has committed the offence (individual or corporation), and whether there have been any previous offences.

Penalties imposed by the ATO under Schedule 1 to the TAA

- Section 284-75 in Schedule 1 to the TAA imposes penalties at law in circumstances where an entity or their agent makes a statement to the Commissioner or another entity exercising powers or performing functions under a taxation law, and the statement is false or misleading in a material particular, whether because of things in it or omitted from it.[15]

- An entity will be liable for the penalty for a statement they or their authorised representatives (including tax agents, BAS agents, authorised employees or other agents[16]) make on their behalf. If an agent (including a registered tax practitioner) exceeds the scope of their authority when making a statement and the entity can prove that responsibility for that statement lies with the agent, the penalty may be imposed on the agent.[17]

Consequences for failing to comply under the TASA

- A breach of any of the requirements in the Determination will constitute a breach of the Code under subsection 30-10(17) of the TASA.

- If the TPB finds that a registered tax practitioner has breached the Code, the TPB may impose one or more of the following sanctions:

- a written caution

- an order requiring the registered tax practitioner to do something specified in the order

- suspension of the registered tax practitioner’s registration

- termination of the registered tax practitioner’s registration

- a period within which a terminated tax practitioner may not re-apply for registration.

- If the TPB finds that a registered tax practitioner has failed to meet an ongoing tax practitioner registration requirement (for example, by no longer being a fit and proper person), the TPB may terminate the tax practitioner’s registration.

- If an individual or entity is found by the TPB to have contravened a civil penalty provision of the TASA (for example, section 50-20), the TPB may apply to the Federal Court of Australia for a civil penalty to be imposed on that individual or entity.

- Ultimately, determining whether a registered tax practitioner has contravened the TASA will be a question of fact. This means that each situation will need to be considered on a case-by-case basis having regard to the particular facts and circumstances of that case.

Case studies

- These case studies provide general guidance only. In all cases, consideration will need to be given to the specific facts and circumstances.

Case study 1 – registered tax practitioner makes a false statement to the TPB in a material matter

Lottie is the sole director of registered BAS agent company, OSH Pty Ltd.

One of OSH Pty Ltd’s employees, Skye, is the only registered BAS agent individual that makes up the sufficient number requirement for OSH Pty Ltd. Skye advises Lottie and the TPB that she is resigning from her employment at OSH Pty Ltd to start her own registered BAS agent business.

After receiving notification from Skye that she will no longer be employed OSH Pty Ltd, the TPB contacts Lottie to clarify whether there are any other individual registered tax or BAS agents engaged by OSH Pty Ltd for the purposes of meeting the sufficient number requirement for OSH Pty Ltd’s BAS agent registration.

Worried that Skye’s resignation will mean that OSH Pty Ltd will lose its registration, and noting that she intends to gain individual BAS agent registration within the coming months, Lottie falsely provides the name and registration number of another registered BAS agent individual as being engaged by OSH Pty Ltd in order to meet the sufficient number registration requirement.

The provision of the false statement on behalf of OSH Pty Ltd is material, as it relates to OSH Pty Ltd’s ongoing eligibility as a registered BAS agent.

In breaching subsection 15(1) of the Determination, OSH Pty Ltd is in breach of subsection 30-10(17) of the TASA, as well as subsection 30-10(1) of the TASA, for failing to act with honesty and integrity. Having regard to the circumstances surrounding Lottie’s conduct as a director of OSH Pty Ltd, the TPB may also find that Lottie is not a fit and proper person to be a director of a registered BAS agent company.

Case study 2 – registered tax practitioner makes a misleading statement to the TPB by omitting a material particular

Esther is a registered tax agent, operating as an individual sole practitioner.

In seeking to renew her tax agent registration, Esther completes the online renewal form, declaring that she continues to meet the ongoing registration requirements. However, Esther was recently declared an undischarged bankrupt, which is an event affecting her continued registration, and a matter that she is required to advise the TPB about.

Esther’s omission of her status as an undischarged bankrupt is material, as it relates to her ongoing eligibility as a registered tax agent.

In breaching subsection 15(1) of the Determination, Esther is in breach of subsection 30-10(17) of the TASA, as well as subsection 30-10(1) of the TASA, for failing to act with honesty and integrity. Having regard to the circumstances surrounding Esther’s conduct, the TPB may also find that Esther is not a fit and proper person to be registered as a tax agent.

Case study 3 – registered tax practitioner ought reasonably to have known that a statement is false in a material particular

Archie was approached by Carter to provide tax agent services to 10 individuals. Carter purported to have authority from the individuals to engage Archie to lodge income tax returns on behalf of the individuals, however Archie did not ask for any proof of identity documentation to verify the identities of the individuals nor did he take any steps to verify Carter’s identity and authority to represent the individuals. Archie noticed that there were discrepancies in the payment summaries provided by Carter for the individuals, and that the bank account details provided by Carter for some individuals were exactly the same as the bank account details provided for others.

In this scenario, Archie ought to reasonably have known that statements he made to the ATO on behalf of the individuals were false in a material particular, being the identities of the individuals making lodgements (and by extension, likely the information being included in the income tax returns). A reasonable tax practitioner in Archie’s circumstances would have undertaken proof of identity checks prior to making the lodgements on behalf of the individuals, including verifying the authority for Carter to engage him on behalf of the individuals.

Upon ATO review activity, it was found that the claims made on behalf of the individuals were fraudulent, and Carter did not have the authority to engage Archie to lodge income tax returns on behalf of them.

Archie is in breach of subsection 15(1) of the Determination for making false and incorrect statements to the Commissioner when he ought to reasonably have known that the statements made were false in material particulars. He is also in breach of subsection 30-10(7) of the TASA, for failing to provide services competently, and subsection 30-10(9) of the TASA, for failing to take reasonable care to ascertain his clients’ state of affairs. Depending on the circumstances, the TPB may also find that Archie is not a fit and proper person to be registered as a tax practitioner.

Case study 4 – registered tax practitioner corrects a false statement previously made to the TPB

Ella, a registered BAS agent, advised the TPB that she was covered by the professional indemnity insurance policy taken out by her employer company FinTax Pty Ltd, and provided the TPB with a policy number and expiry date that she believed was the professional indemnity insurance policy that she was covered by.

Upon undertaking an annual review of FinTax Pty Ltd’s insurance policies, it became apparent that Ella was not actually covered by the professional indemnity insurance policy held by the company. As such, statements made by FinTax Pty Ltd and Ella regarding meeting the TPB’s professional indemnity insurance requirements and accompanying policy details were false.

Fintax Pty Ltd promptly updated its professional indemnity insurance policy to ensure that the provision of tax agent services by all employees and contractors on behalf of the company are covered, and Fintax Pty Ltd and Ella subsequently advised that the TPB of the false statements that had previously been provided, and the new and correct professional indemnity insurance details.

While this conduct by Fintax Pty Ltd and Ella gave rise to breaches of subsection 15(1) of the Determination and subsection 30-10(13) of the TASA (failing to maintain professional indemnity insurance that meets the TPB’s requirements), due to the goodwill of Ella and Fintax Pty Ltd correcting the false statement and ensuring compliance with the TPB’s professional indemnity insurance requirements going forward, the TPB decided to take no further action against Ella and issued Fintax Pty Ltd with a written caution as a result of the breaches found.

Case study 5 – registered tax practitioner makes a false and misleading statement to the Commissioner on behalf of their client, that they knew was false in a material particular

Julian, a registered tax agent, was identified by the ATO as having high work-related expense (WRE) claims across his client base. Over 100 client audits were completed, and during the audits, the types of behaviours noted by the ATO demonstrated that Julian made statements to the Commissioner that were incorrect, and contrary to the information available to him.

Examples included:

- Julian was unable to substantiate claims made for his clients, and his working papers did not support deductions claimed in the returns.

- Car expenses were claimed without logbooks having been kept.

- Self-education expenses were claimed where the employer had reimbursed or paid directly for the expense.

- Inappropriate medical expenses were claimed.

- Home office claims, where there was no evidence that the client worked from home.

Through the ATO’s audit activity, including by interviewing Julian’s clients, it became clear that the clients had provided all relevant and accurate information and records to Julian when engaging him to complete their income tax returns.

Julian is in breach of subsection 15(1) of the Determination by preparing statements to the Commissioner that he knew to be false in a material particular/s.

Case study 6 – registered tax practitioner notifies the Commissioner about an incorrect statement prepared on behalf of a client

Kate, a registered tax agent, was instructed by her client Peter to complete his income tax return for the last financial year.

Upon reviewing the information provided by Peter and using the pre-filling function on the ATO’s system, Kate realised that statements made in Peter’s previous income tax return, also prepared by Kate as per Peter’s earlier instructions, were incorrect, which meant that Peter received a higher income tax refund than what he was legally entitled to.

Kate advised Peter that he needed to either correct the incorrect statement with the ATO or instruct Kate or another registered tax practitioner to lodge an amendment to the previously lodged income tax return. With the ATO’s two-year time limit for lodging amendments to individual tax returns approaching, Kate advised Peter that if he did not take steps to correct the statement within 5 business days (or instruct her to do so), Kate would be required under her obligations as a registered tax practitioner to notify the ATO of the incorrect statement made in Peter’s previous income tax return.

Unfortunately, noting that he would likely have to repay the entitlement he was incorrectly paid, Peter told Kate that he did not permit her to correct the statement made in his income tax return, that he no longer wished to engage Kate to lodge his income tax returns, and that he was terminating her engagement immediately.

Despite Peter’s remarks that he does not permit Kate to correct the incorrect statement she previously prepared on his behalf with the ATO, Kate has an obligation under the Determination to take reasonable steps to notify the Commissioner that a statement she prepared was incorrect in a material particular. Kate considers that in the circumstances it is unlikely that Peter will correct the statement within a reasonable time. As such, and to ensure that she is not in breach of her obligations under the Determination, Kate decides to notify the ATO about the incorrect statement in Peter’s previous income tax return.

Kate has satisfied the requirements in subsection 15(2) of the Determination. Further, Kate is not in breach of Code item 6,[18] as she had a legal duty to disclose Peter’s information to the ATO, in order to correct the incorrect statement she prepared for him. Kate is also not in breach of Code item 4,[19] as while Peter may assert that she has not acted in his best interests, if Kate had decided to not notify the ATO about the incorrect statement, Kate’s conduct would have been unlawful. Kate considers whether she needs to report a significant breach to the TPB in respect of the incorrect statement made in Peter’s return, but after reading the TPB’s breach reporting guidance, and given that she took reasonable steps to ascertain Peter’s state of affairs when she prepared the statement in question, Kate does not have a reasonable belief that she has breached the Code. Kate appropriately decides that a breach report to the TPB is not necessary and therefore does not contravene the breach reporting requirements in the TASA by not notifying the TPB about the matter.

Further information

- Outlined below is a listing of reference material that may provide further guidance in relation to issues to consider in relation to false and misleading statements:

| Agency | |

|---|---|

| Tax Practitioners Board | |

| Information product | TPB(I) D53/2024 Breach reporting under the Tax Agent Services Act 2009 |

| Purpose of document | Assists registered tax practitioners understand the breach reporting obligations under sections 30-35 and 30-40 of the TASA, which apply from 1 July 2024. |

| TPB(I) 17/2013 Code of Professional Conduct – Reasonable care to ascertain a client’s state of affairs | |

| Information product | Provide guidance in relation to what it means to take reasonable care under subsection 30-10(9) of the TASA. |

| Website guidance: tpb.gov.au/change-registration-details-or-circumstances | |

| Information product | Further information about the requirement of tax practitioners to notify the TPB of certain changes to their circumstances. |

| ATO | |

| Information product | Practice Statement Law Administration PS LA 2012/4 Administration of the false or misleading statement penalty – where there is no shortfall amount |

| Purpose of document | Further information in respect of the Commissioner’s administration of penalty provisions in section 284-75 in Schedule 1 to the TAA. |

| Practice Statement Law Administration PS LA 2012/5 Administration of the false or misleading statement penalty – where there is a shortfall amount. | |

| Information product | Further information in respect of the Commissioner’s administration of penalty provisions in section 284-75 in Schedule 1 to the TAA. |

| Miscellaneous Taxation Ruling MT 2008/1 Penalty relating to statements: meaning of reasonable care, recklessness and intentional disregard | |

| Information product | Provides the Commissioner's interpretation of the concepts 'reasonable care', 'recklessness' and 'intentional disregard' as used in Subdivision 284 B and 'intentional disregard' and 'recklessness' as used in subsection 286 75(1A) of Schedule 1 to the TAA. |

| Agency | Information product | Purpose of document |

| Tax Practitioners Board | TPB(I) D53/2024 Breach reporting under the Tax Agent Services Act 2009 | Assists registered tax practitioners understand the breach reporting obligations under sections 30-35 and 30-40 of the TASA, which apply from 1 July 2024. |

| TPB(I) 17/2013 Code of Professional Conduct – Reasonable care to ascertain a client’s state of affairs | Provide guidance in relation to what it means to take reasonable care under subsection 30-10(9) of the TASA. | |

| Website guidance: tpb.gov.au/change-registration-details-or-circumstances | Further information about the requirement of tax practitioners to notify the TPB of certain changes to their circumstances. | |

| ATO | Practice Statement Law Administration PS LA 2012/4 Administration of the false or misleading statement penalty – where there is no shortfall amount | Further information in respect of the Commissioner’s administration of penalty provisions in section 284-75 in Schedule 1 to the TAA. |

| Practice Statement Law Administration PS LA 2012/5 Administration of the false or misleading statement penalty – where there is a shortfall amount. | Further information in respect of the Commissioner’s administration of penalty provisions in section 284-75 in Schedule 1 to the TAA. | |

| Miscellaneous Taxation Ruling MT 2008/1 Penalty relating to statements: meaning of reasonable care, recklessness and intentional disregard | Provides the Commissioner's interpretation of the concepts 'reasonable care', 'recklessness' and 'intentional disregard' as used in Subdivision 284 B and 'intentional disregard' and 'recklessness' as used in subsection 286 75(1A) of Schedule 1 to the TAA. |

Consultation questions

- The TPB welcomes submissions addressing all aspects of this draft TPB(I). The following consultations questions may assist you in providing feedback:

| Consultation questions | |

|---|---|

| Q1 | |

| Are there additional types of statements routinely made or prepared by registered tax practitioners (or under the direction of registered tax practitioners), that should be specifically addressed by the guidance (including case studies)? | |

| Q2 | |

| Are there additional matters to those listed in paragraph 26 that may impact the materiality of a particular about which a statement is made? | |

| Q3 | |

| When advising the maker of a statement that the statement should be corrected, are there additional factors than those listed in paragraph 37 that the tax practitioner may take into account when determining a reasonable period within which the statement should be corrected? | |

| Q4 | |

| Are there additional case study scenarios that would assist registered tax practitioners in understanding how the obligations apply practically? If so, what types of scenarios should be addressed? | |

| Q5 | |

| Are there additional practical considerations for registered tax practitioners relevant to the obligations in section 15 of the Determination that should be addressed in the guidance? | |

| Consultation questions | |

|---|---|

| Q1 | Are there additional types of statements routinely made or prepared by registered tax practitioners (or under the direction of registered tax practitioners), that should be specifically addressed by the guidance (including case studies)? |

| Q2 | Are there additional matters to those listed in paragraph 26 that may impact the materiality of a particular about which a statement is made? |

| Q3 | When advising the maker of a statement that the statement should be corrected, are there additional factors than those listed in paragraph 37 that the tax practitioner may take into account when determining a reasonable period within which the statement should be corrected? |

| Q4 | Are there additional case study scenarios that would assist registered tax practitioners in understanding how the obligations apply practically? If so, what types of scenarios should be addressed? |

| Q5 | Are there additional practical considerations for registered tax practitioners relevant to the obligations in section 15 of the Determination that should be addressed in the guidance? |

References

[1] The provisions of the Code are contained in section 30-10 of the TASA. The TPB has also published an explanatory paper that sets out its views on the application of the Code, including Code obligations 5 and 6. Refer to TPB Explanatory paper TPB(EP) 01/2010 Code of Professional Conduct.

[2] For further information, see TPB Explanatory paper TPB (EP) 02/2010 Fit and proper person.

[3] Explanatory Statement to the Tax Agent Services (Code of Professional Conduct) Determination 2023.

[4] Ibid.

[5] Ibid.

[6] Section 284-75 of the Taxation Administration Act 1953 (TAA) imposes penalties under various circumstances where an entity (or their agent) makes a false or misleading statement to the Commissioner or other entities in limited circumstances.

[7]A taxation document in this context means any return, notice, statement or other document given to the Commissioner in the *approved form within the meaning of section 388-50 in Schedule 1 to the TAA.

[8] Further information in relation to notification requirements for tax practitioners is provided in TPB(I) D53/2023 Obligation to notify actual and potential breaches of the Tax Agent Services Act 2009

[9] Further information in relation to what it means to take reasonable care to ascertain a client’s state of affairs is provided in TPB(I) 17/2013 Code of Professional Conduct – Reasonable care to ascertain a client’s state of affairs.

[10] Further information about the requirement of tax practitioners to notify the TPB of certain changes to their circumstances can be found at tpb.gov.au/change-registration-details-or-circumstances

[11] Further information in relation to notification requirements for tax practitioners is provided in TPB(I) D53/2023 Obligation to notify actual and potential breaches of the Tax Agent Services Act 2009

[12] Subsection 30-10(6) of the TASA provides that unless they have a legal duty to do so, registered tax practitioners must not disclose any information relating to a client’s affairs to a third party without the client’s permission.

[13] Subsection 8K(2) of the TAA.

[14] An offence of ‘absolute liability’ is an offence where no fault elements apply to the physical elements of the offence and the defence of reasonable mistake is not available: section 6.2 of the Criminal Code Act 1995 (Cth), which applies to offences under the TAA.

[15] Subsections 284-75(1) and (4) in Schedule 1 to the TAA imposes numerous penalties relating to the making of false and misleading statements in various circumstances.

[16] Under commercial law, an agent is a person who is either expressly or impliedly authorised by a principal to act for that principal so as to create or effect legal relations between the principal and third parties. An act done by the agent on behalf of the principal is considered an act of that principal.

[17] Further information in respect of the Commissioner’s administration of these penalty provisions can be found in Practice Statement Law Administration PS LA 2012/4 Administration of the false or misleading statement penalty – where there is no shortfall amount and Practice Statement Law Administration PS LA 2012/5 Administration of the false or misleading statement penalty – where there is a shortfall amount.

[18] Code item 6 provides that unless you have a legal duty to do so, you must not disclose any information relating to a client's affairs to a third party without your client's permission.

[19] Code item 4 provides that you must act lawfully in the best interests of your client.