- Tax Practitioners Board exposure draft

- Introduction

- Background

- What are the obligations under section 10?

- Upholding and promoting the Code

- Not engaging in conduct that undermines the tax profession and tax system

- Not engaging in conduct that undermines the collective work of the tax profession

- Case studies

- Case study 1 – Individual registered tax practitioner fails to uphold and promote the Code

- Case study 2 – Registered tax practitioner company undermines the collective work of the tax profession

- Case study 3 – Registered tax practitioner company does not engage in conduct that undermines the tax profession

- Consultation questions

- Appendix A – Summary of obligations under the Code of Professional Conduct

- Reference

Tax Practitioners Board exposure draft

The Tax Practitioners Board (TPB) has released this draft Information Sheet (TPB(I) D56/2024) as an exposure draft and invites comments and submissions in relation to the information contained in it within 28 days. The closing date for submissions is 21 November 2024. The TPB will then consider any submissions before settling its position, undertaking any further consultation required and finalising the TPB(I).

Written submissions should be made via email at tpbsubmissions@tpb.gov.au or by mail to:

Tax Practitioners Board

GPO Box 1620

SYDNEY NSW 2001

Disclaimer

This document is in draft form, and when finalised, will be intended as information only. It provides information regarding the TPB’s position on the application of section 10 of the Tax Agent Services (Code of Professional Conduct) Determination 2024.

While this draft TPB(I) seeks to provide practical assistance and explanation, it does not exhaust, prescribe or limit the scope of the TPB’s powers in the TASA. In addition, please note that the principles, explanations and examples in this draft TPB(I) do not constitute legal advice and do not create additional rights or legal obligations beyond those that are contained in the TASA or which may exist at law.

Document history

This draft TPB(I) was issued on 24 October 2024 and is based on the TASA as at the date of issue

Issue date:24 October 2024

Introduction

- This draft Information sheet (TPB(I)) has been prepared by the Tax Practitioners Board (TPB) to assist registered tax agents and BAS agents (collectively referred to as ‘registered tax practitioners’) to understand their obligations under section 10 of the Tax Agent Services (Code of Professional Conduct) Determination 2024 (Determination).

- While the focus of this draft TPB(I) is on the obligations in section 10 of the Determination, it is important to note that there are also 17 obligations in the Code of Professional Conduct (Code),[1] additional obligations in the Determination, and further requirements that registered tax practitioners must comply with under the Tax Agent Services Act 2009 (TASA). These include ongoing requirements in relation to maintaining registration under the TASA, including that a registered tax practitioner is a ‘fit and proper’ person.[2]

- In this draft TPB(I), you will find information on:

- background to the legislative requirement (paragraphs 4 to 9)

- details of the obligations under section 10 (paragraphs 10 to 29)

- case studies (paragraph 30)

- consultation questions (paragraph 31).

Background

- Section 30-10 of the TASA contains the Code, comprising 17 items which regulate the personal and professional conduct of all registered tax practitioners.

- One of these obligations is contained in subsection 30-10(17) of the TASA, which requires registered tax practitioners to comply with any obligations that the Minister determines, by legislative instrument, under section 30-12 of the TASA.

- On 1 July 2024, the Minister determined 8 additional Code obligations, set out in the Determination. These additional Code obligations apply from:

- The delayed application date provides registered tax practitioners time to understand their obligations, assess their own practice and implement changes, if required, to comply with their obligations under the Determination from the relevant application date under paragraph 6 above.

- More specifically, the obligations under section 10 of the Determination applies to conduct that occurs on or after the relevant application date under paragraph 6 above.[5]

- For further information on the Determination, please refer to the TPB’s website guidance The Code Determination – Background and context. This document provides additional background information including in relation to:

- the process to finalise the Determination

- commencement and application date

- the TPB’s approach to support implementation.

What are the obligations under section 10?

- Section 10 of the Determination requires registered tax practitioners, independently and in cooperation with other registered tax practitioners, to:

- uphold and promote the Code, and

- not engage in any conduct that they know, or ought reasonably to know, may:

- undermine public trust and confidence in the integrity of the tax profession (including conduct that discredits the tax profession or brings the tax profession into disrepute) or

- undermine public trust and confidence in the integrity of the tax system, and

- not engage in any conduct that they know, or ought reasonably to know, may undermine the collective work of registered tax practitioners, as a tax profession, to uphold and promote:

- the Code

- public trust and confidence in the integrity of the tax profession and tax system

- each member of the profession being held accountable for their individual conduct.

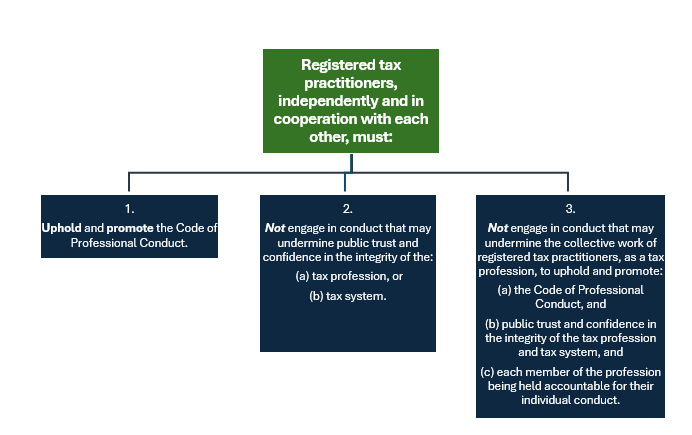

Figure 1 below provides a diagrammatic summary of the obligations under section 10 of the Determination.

Figure 1 – Summary of requirements of section 10 of the Determination

- It is important to note that the obligations set out in section 10 of the Determination are consistent with other obligations of registered tax practitioners, such as the obligation to act honestly and with integrity under subsection 30-10(1) of the TASA (Code Item 1)[6] and the breach reporting notification requirements [7] in subdivision 30-C of the TASA. They are also generally consistent with standards set for members of the accounting profession by the Accounting Professional & Ethical Standards Board (APESB) in APES 110 Code of Ethics for Professional Accountants (including Independence Standards) and APES 220 Taxation Services, particularly regarding principles of integrity and professional behaviour.[8]

- The obligations under section 10 of the Determination apply to registered tax practitioners both in their own capacity and in cooperation with other tax practitioners. This recognises that tax agent services are often provided collectively by multiple people within an organisation, working in cooperation with each other. Registered tax practitioners are responsible for the conduct of any unregistered individuals, such as employees, contractors and any other assistants providing tax agent services on their behalf, in order to meet their obligations as registered tax practitioners.[9]

- Section 10 of the Determination encourages a tax profession with high ethical values that does not engage in misconduct, that does not turn a blind eye to misconduct and does not shy away from taking action against the misconduct of another registered tax practitioner in order to maintain public trust and confidence in the tax profession and tax system.

- Section 10 of the Determination also applies to tax practitioners in any professional role. This recognises that all registered tax practitioners play an important role in upholding an ethical tax profession and system that the public can trust and rely upon.[10]

- The three key concepts contained in section 10 of the Determination are explained further below.

Upholding and promoting the Code

- Paragraph 10(a) of the Determination requires registered tax practitioners to uphold and promote the Code. The phrase ‘uphold and promote’ is not defined in the TASA and therefore is given its ordinary meaning, having regard to the purpose of the provision and its statutory context. The term ‘uphold’ means to support or maintain. ‘Promote’ in this statutory context means to further growth, development or progress.[11]

- The phrase ‘uphold and promote’ involves registered tax practitioners ensuring that they both individually and in cooperation with other registered tax practitioners, support and further compliance with the Code to ensure they satisfy paragraph 10(a) of the Determination. This includes upholding and promoting the 17 items of the Code contained in section 30-10 of the TASA, which are summarised in the table at Appendix A to this draft TPB(I).

- In practice, how a registered tax practitioner meets the obligation to uphold and promote the Code will depend on the individual circumstances of each registered tax practitioner, including the size and nature of a particular tax practice and the degree of authority and control of an individual within a firm.

- Generally, registered tax practitioners can demonstrate their compliance with paragraph 10(a) of the Determination by ensuring their own compliance with the Code on an ongoing basis, and by taking reasonable steps to implement practical measures to uphold and promote the Code in their tax practice. Without limiting the scope of the obligation, tax practices, in cooperation with individual tax practitioners within them, should institute measures such as:

- providing training and resources on complying with the Code

- introducing and actively undertaking processes to manage underperformance in relation to breaches of the Code

- instituting mechanisms for staff to report and address concerns about conduct that may breach the Code

- providing appropriate and adequate protection for staff that report conduct that may breach the Code

- providing directions to staff not to engage in specific conduct where that conduct may result in a breach of the Code

- maintaining appropriate records relating to potential breaches of the Code

- processes for amending or correcting false or misleading statements in documents or conversations

- having recruitment processes that include police checks, checks of the TPB’s register and checks to test whether someone is a disqualified entity

- encouraging compliance with the Code when considering remuneration, including promotions and bonuses, as well as in other human resource policies

- developing a culture of transparency, accountability, ethical conduct, and compliance with the Code and with the tax laws.[12]

- Not all of these measures will be relevant for every registered tax practitioner. For example, the measures referencing ‘staff’ will not be applicable to sole practitioner firms operating without staff. In these circumstances, the sole practitioner will be well advanced in complying with paragraph 10(a) of the Determination by merely complying with the Code themselves and encouraging compliance amongst their peers in the profession, as appropriate.

- Ultimately, registered tax practitioners should exercise their professional judgement, having regard to the facts and circumstances of their firm, in considering whether they are upholding and promoting the Code to a reasonable standard.

Not engaging in conduct that undermines the tax profession and tax system

- Paragraph 10(b) of the Determination recognises that public trust and confidence in the tax profession and tax system is influenced by the actions of registered tax practitioners, and that misconduct by individual tax practitioners reflects on the profession and the tax system as a whole. Any conduct that is likely to have the effect of undermining public trust and confidence in the tax profession and tax system, where the registered tax practitioner knows or ought reasonably to know that the conduct is likely to have that effect, will be a breach of the Code. Considered feedback or submissions, which may include criticism, on public consultation documents that is done professionally is not considered conduct in breach of paragraph 10(b) of the Determination.

- The phrase 'know or ought reasonably to know’ has two elements. The term ‘know’ refers to actual knowledge. The phrase ‘ought reasonably to know’ extends to constructive knowledge, where a person is taken to have knowledge about their conduct, if the existence of that conduct could be discovered by a reasonable person in the same position as the person, making reasonable enquiries. The relevant factors in determining whether a registered tax practitioner ought reasonably to know in any given scenario will always depend on the circumstances and must be considered on a case-by-case basis.

- A registered tax practitioner must therefore ensure they not engage in conduct that they know, or ought reasonably know, undermines the tax profession and tax system, including conduct that discredits the tax profession or brings the tax profession into disrepute. This includes any conduct that reduces public confidence in registered tax practitioners and their ability to fulfil their role.

Not engaging in conduct that undermines the collective work of the tax profession

- Paragraph 10(c) of the Determination recognises an expectation that the tax profession works collectively, including through professional bodies, to uphold and promote the Code, public trust and confidence in the tax profession and tax system, and holding each other accountable for a registered tax practitioner’s own actions. Any conduct that might undermine those collective efforts, provided that the registered tax practitioner knows, or ought reasonably to know, that the conduct might have that effect, will be a breach of the Code.

- Conduct that undermines the collective work of the tax profession includes conduct that erodes the reputation of registered tax practitioners as a profession, or diminishes their standing in the public eye.

- The meaning of the phrase 'know or ought reasonably to know’ is outlined at paragraph 24 above.

- Without limiting the scope of the section, the following would very likely be evidence of a breach of section 10 of the Determination:

- not removing staff from a project or work area where there are reasonable concerns about potential unethical conduct relating to the project or work area

- asking not to be informed of, or for appropriate records to be made of, information relating to potential breaches of the Code

- destroying evidence relating to any potential breach of the Code

- taking or threatening any adverse action against an individual who raises concerns about potentially unethical conduct

- rewarding or encouraging an individual in relation to conduct that is unethical or not discouraging such unethical behaviour.[13]

Case studies

- These case studies provide general guidance only. In all cases, consideration will need to be given to the specific facts and circumstances.

Case study 1 – Individual registered tax practitioner fails to uphold and promote the Code

Situation

Sam is a registered tax agent, operating with the support of two junior accountants.

Sam is contacted by his friend, Adam, to prepare and lodge his income tax return. Adam advises Sam that he has recently divorced his wife, Carol. Later that same week, Sam is also engaged by Carol to prepare and lodge her income tax return.

Sam delegates the work relating to Adam to one of his junior accountants and the work relating to Carol to his other junior accountant. The junior accountants identify that there may be a conflict of interest for the firm to be providing services to both Adam and Carol and jointly raise their concerns with Sam via email.

Sam dismisses his staff’s concerns on the basis that they are a small firm and need the professional fees. Sam instructs his junior accountants to proceed with the work. Sam does not make any other record relating to the potential conflict and deletes the email from his staff which evidences that they raised the issue.

Is there a breach of section 10 of the Determination?

Sam has failed to comply with section 10 of the Determination, and as a result, he has breached subsections 30-10(5) and (17) of the TASA, for failing to uphold and promote the Code and have adequate arrangements in place for the management of conflicts of interest, noting in particular that Sam has:

- failed to have adequate arrangements in place for the management of conflicts of interest that have arisen in relation to his activities in his capacity as a registered tax agent

- failed to provide directions to staff not to engage in specific conduct where that conduct may result in a breach of the Code

- failed to maintain appropriate records relating to a potential breach of the Code

- destroyed evidence relating to a potential breach of the Code

- failed to develop and maintain a culture of transparency, accountability, ethical conduct, and compliance with the Code.

Having regard to the circumstances surrounding Sam’s conduct, the TPB may also find that Sam has breached other obligations under the Code, such as the obligation to act honestly and with integrity under subsection 30-10(1) of the TASA. In addition, the TPB may find that he is not a fit and proper person to be registered as a tax agent.

Case study 2 – Registered tax practitioner company undermines the collective work of the tax profession

Situation

Anne is a director of registered tax agent company, KDG Pty Ltd.

Anne was approached by an employee of the company, James, who works solely under one of the supervising registered tax agents for the company, Lachlan. James had some concerns about Lachlan’s potentially unethical conduct in the company.

James claimed he had seen Lachlan providing tax agent services to a large number of clients recently without asking for any proof of identity documentation to verify the identities of the clients and he had exaggerated claims on behalf of clients in their income tax returns to ensure they all received substantial tax refunds. James had raised these concerns previously with Lachlan, but they were disregarded.

Having discussed this matter, Anne checked the client files and found evidence of the claims James had raised with her. She was immediately concerned with how this would look for the company if James raised this any further. Anne subsequently met with James and advised that he should not be questioning Lachlan’s work and asked James to refrain from pursuing these types of matters. Anne further added that if James continued to raise this issue, it would be detrimental to his future career in the company. She then deleted her email communications with James which discussed Lachlan’s conduct and continued to employ Lachlan as a supervising registered tax agent for the company.

The TPB later investigated Lachlan’s conduct and found that he and KDG Pty Ltd had both breached subsection 15(1) of the Determination for making false and incorrect statements to the Commissioner of Taxation when they ought to reasonably have known that the statements made were false in material particulars. Lachlan and KDG Pty Ltd also breached subsection 30-10(7) of the TASA, for failing to provide services competently, and subsection 30-10(9) of the TASA, for failing to take reasonable care to ascertain their clients’ state of affairs.

Is there a breach of section 10 of the Determination?

KDG Pty Ltd is in breach of section 10 of the Determination for engaging in conduct that undermines the collective work of the tax profession, given the company did not hold its supervising registered tax agent, Lachlan, accountable for his actions. In making this finding regarding the breach of section 10 of the Determination, the TPB also noted that the company:

- failed to remove or discipline Lachlan where there were reasonable concerns about potential unethical conduct relating to his work

- asked not to be informed of, or for appropriate records to be made of, information relating to potential breaches of the Code

- destroyed evidence relating to potential breaches of the Code

- threatened adverse action against James when he raised concerns about potentially unethical conduct.

Case study 3 – Registered tax practitioner company does not engage in conduct that undermines the tax profession

Situation

Tom is a director of registered BAS agent company, Mulholland Services Pty Ltd.

Tom conducts an annual review of his employees’ records for compliance purposes. He identifies that three out of the five supervising registered BAS agents for the company have not completed any continuing professional education (CPE) activities during the year, even though they are required by the TPB to complete at least 20 hours each year as part of their CPE requirements under subsection 30-10(8) of the TASA.

Tom is concerned that the three supervising registered BAS agents have fallen behind in their CPE requirements and this could impact the company’s registration if it does not have a sufficient number of individual registered tax practitioners to provide BAS services to a competent standard. Tom begins to raise these concerns with the three supervising registered BAS agents, so that he can ensure that the company has sufficient qualifications and experience to provide BAS services competently. These BAS agents each explain that they were not able to allocate time to complete their CPE activities during the year due to the substantial increases in their workloads. Tom takes this into consideration and then carries out the following steps:

- provides resources to the three supervising registered BAS agents on complying with their CPE requirements under the Code

- reallocates work of a more complex nature from the three supervising registered BAS agents to the remaining two supervising registered BAS agents who are up-to-date with their CPE requirements

- provides directions to the three supervising registered BAS agents to complete their CPE activities before the end of the year in accordance with the TPB’s CPE requirements

- asks the three supervising registered BAS agents to maintain appropriate records of the CPE activities they have completed and to inform him if they are not able to comply with their CPE requirements before the end of the year

- records a file note for the issue and of their discussions, since it relates to potential breaches of the Code by the three supervising registered BAS agents for failing to maintain knowledge and skills relevant to the BAS services they are providing for the company.

Is there a breach of section 10 of the Determination?

Mulholland Services Pty Ltd has complied with section 10 of the Determination because the company held its supervisory BAS agents accountable and actively undertook processes to manage underperformance in relation to their CPE requirements under the Code. Further, the company did not engage in any conduct that undermined public trust and confidence in the integrity of the tax profession, and instead maintained a culture of transparency, accountability, ethical conduct, and compliance with the Code.

Consultation questions

| Consultation questions | |

|---|---|

| Q1 | |

| Do you have any general comments regarding the guidance on the obligation to uphold and promote the ethical standards of the tax profession under section 10 of the Determination? | |

| Q2 | |

| In relation to paragraph 20 which provide a non-exhaustive list of practical measures that should be implemented in a tax practice, are these measures adequate and appropriate? If not, please provide further details, including any additional measures that should be included. | |

| Q3 | |

| In relation paragraph 29 which provides a non-exhaustive examples of breaches of section 10 of the Determination, are there any additional examples that should be included which demonstrate a failure to uphold and promote the ethical standards of the tax profession? Please provide further details. | |

| Q4 | |

| Are there any additional case study scenarios that would assist registered tax practitioners in understanding how the obligations under section 10 of the Determination apply practically? If so, what types of scenarios should be addressed? | |

| Consultation questions | |

| Q1 | Do you have any general comments regarding the guidance on the obligation to uphold and promote the ethical standards of the tax profession under section 10 of the Determination? |

| Q2 | In relation to paragraph 20 which provide a non-exhaustive list of practical measures that should be implemented in a tax practice, are these measures adequate and appropriate? If not, please provide further details, including any additional measures that should be included. |

| Q3 | In relation paragraph 29 which provides a non-exhaustive examples of breaches of section 10 of the Determination, are there any additional examples that should be included which demonstrate a failure to uphold and promote the ethical standards of the tax profession? Please provide further details. |

| Q4 | Are there any additional case study scenarios that would assist registered tax practitioners in understanding how the obligations under section 10 of the Determination apply practically? If so, what types of scenarios should be addressed? |

Appendix A – Summary of obligations under the Code of Professional Conduct

| Honesty and integrity | |

|---|---|

Code item 1 | |

| You must act honestly and with integrity | |

Code item 2 | |

| You must comply with the taxation laws in the conduct of your personal affairs | |

Code item 3 | |

| If you receive money or other property from or on behalf of a client and you hold the money or other property on trust, you must account to your client for the money or other property | |

| Independence | |

| Code item 4 | |

| You must act lawfully in the best interests of your client | |

| Code item 5 | |

| You must have in place adequate arrangements for the management of conflicts of interest that may arise in relation to the activities that you undertake in the capacity of a registered tax practitioner | |

| Confidentiality | |

| Code item 6 | |

| Unless you have a legal duty to do so, you must not disclose any information relating to a client’s affairs to a third party without your client’s permission | |

| Competence | |

| Code item 7 | |

| You must ensure that a tax agent service that you provide, or that is provided on your behalf, is provided competently | |

| Code item 8 | |

| You must maintain knowledge and skills relevant to the tax agent services that you provide | |

| Code item 9 | |

| You must take reasonable care in ascertaining a client’s state of affairs, to the extent that ascertaining the state of those affairs is relevant to a statement you are making or a thing you are doing on behalf of the client | |

| Code item 10 | |

| You must take reasonable care to ensure that *taxation laws are applied correctly to the circumstances in relation to which you are providing advice to a client | |

| Other responsibilities | |

| Code item 11 | |

| You must not knowingly obstruct the proper administration of the taxation laws | |

| Code item 12 | |

| You must advise your client of the client’s rights and obligations under the taxation laws that are materially related to the tax agent services you provide | |

| Code item 13 | |

| You must maintain professional indemnity insurance that meets the TPB’s requirements | |

| Code item 14 | |

| You must respond to requests and directions from the TPB in a timely, responsible and reasonable manner | |

| Code item 15 | |

You must not employ, or use the services of, an entity to provide tax agent services on your behalf if: (a) you know, or ought reasonably to know, that the entity is a disqualified entity; and (b) the TPB has not given you approval under section 45‑5 of the TASA to employ, or use the services of, the disqualified entity to provide tax agent services on your behalf | |

| Code item 16 | |

| You must not provide tax agent services in connection with an arrangement with an entity that you know, or ought reasonably to know, is a disqualified entity | |

| Code item 17 | |

| You must comply with any obligations determined under section 30‑12 of the TASA | |

| Honesty and integrity | |

Code item 1 | You must act honestly and with integrity |

Code item 2 | You must comply with the taxation laws in the conduct of your personal affairs |

Code item 3 | If you receive money or other property from or on behalf of a client and you hold the money or other property on trust, you must account to your client for the money or other property |

| Independence | |

| Code item 4 | You must act lawfully in the best interests of your client |

| Code item 5 | You must have in place adequate arrangements for the management of conflicts of interest that may arise in relation to the activities that you undertake in the capacity of a registered tax practitioner |

| Confidentiality | |

| Code item 6 | Unless you have a legal duty to do so, you must not disclose any information relating to a client’s affairs to a third party without your client’s permission |

| Competence | |

| Code item 7 | You must ensure that a tax agent service that you provide, or that is provided on your behalf, is provided competently |

| Code item 8 | You must maintain knowledge and skills relevant to the tax agent services that you provide |

| Code item 9 | You must take reasonable care in ascertaining a client’s state of affairs, to the extent that ascertaining the state of those affairs is relevant to a statement you are making or a thing you are doing on behalf of the client |

| Code item 10 | You must take reasonable care to ensure that *taxation laws are applied correctly to the circumstances in relation to which you are providing advice to a client |

| Other responsibilities | |

| Code item 11 | You must not knowingly obstruct the proper administration of the taxation laws |

| Code item 12 | You must advise your client of the client’s rights and obligations under the taxation laws that are materially related to the tax agent services you provide |

| Code item 13 | You must maintain professional indemnity insurance that meets the TPB’s requirements |

| Code item 14 | You must respond to requests and directions from the TPB in a timely, responsible and reasonable manner |

| Code item 15 | You must not employ, or use the services of, an entity to provide tax agent services on your behalf if: (a) you know, or ought reasonably to know, that the entity is a disqualified entity; and (b) the TPB has not given you approval under section 45‑5 of the TASA to employ, or use the services of, the disqualified entity to provide tax agent services on your behalf |

| Code item 16 | You must not provide tax agent services in connection with an arrangement with an entity that you know, or ought reasonably to know, is a disqualified entity |

| Code item 17 | You must comply with any obligations determined under section 30‑12 of the TASA |

In relation to Code item 17, the Determination contains 8 additional obligations, which are summarised in the table below:

| Section 10 | |

|---|---|

| Section 15 | |

| You must uphold and promote the ethical standards of the tax profession | You must not make false or misleading statements to the Board or the Commissioner |

| Section 20 | |

| You must uphold and promote the ethical standards of the tax profession | You must manage conflicts of interest in activities undertaken for government |

| Section 25 | |

| You must uphold and promote the ethical standards of the tax profession | You must maintain confidentiality in dealings with government |

| Section 30 | |

| You must uphold and promote the ethical standards of the tax profession | You must keep proper client records |

| Section 35 | |

| You must uphold and promote the ethical standards of the tax profession | You must ensure tax agent services provided on your behalf are provided competently |

| Section 40 | |

| You must uphold and promote the ethical standards of the tax profession | You must establish and maintain quality management systems |

| Section 45 | |

| You must uphold and promote the ethical standards of the tax profession | You must keep your clients informed |

| Section 10 | You must uphold and promote the ethical standards of the tax profession |

| Section 15 | You must not make false or misleading statements to the Board or the Commissioner |

| Section 20 | You must manage conflicts of interest in activities undertaken for government |

| Section 25 | You must maintain confidentiality in dealings with government |

| Section 30 | You must keep proper client records |

| Section 35 | You must ensure tax agent services provided on your behalf are provided competently |

| Section 40 | You must establish and maintain quality management systems |

| Section 45 | You must keep your clients informed |

Reference

[1] The provisions of the Code are contained in section 30-10 of the TASA. The TPB has also published an explanatory paper that sets out its views on the application of the Code. Refer to TPB Explanatory paper TPB(EP) 01/2010 Code of Professional Conduct.

[2] For further information, see TPB Explanatory paper TPB (EP) 02/2010 Fit and proper person.

[3] This includes new registered tax practitioners with 100 or less employees that register between 1 August 2024 and 30 June 2025 inclusive.

[4] See the Tax Agent Services (Code of Professional Conduct) Amendment (Measures No. 1) Determination 2024.

[5] See subsection 100(1) of the Determination.

[6] See the TPB Explanatory Paper TPB(EP) 01/2010 Code of Professional Conduct.

[7] Further information in relation to notification requirements for tax practitioners is provided in TPB(I) D53/2024 Breach reporting under the Tax Agent Services Act 2009.

[8] APESB standards apply to registered tax practitioners who are members of Chartered Accountants Australia and New Zealand, CPA Australia or the Institute of Public Accountants.

[9] See the eligibility criteria for registration contained in paragraphs 20-5(2)(c) and 20-5(3)(d) of the TASA.

[10] See Explanatory Statement to the Tax Agent Services (Code of Professional Conduct) Determination 2024.

[11] The Macquarie Dictionary, Macmillan Publishers Australia, 2023.

[12] See Explanatory Statement to the Tax Agent Services (Code of Professional Conduct) Determination 2024.

[13] See Explanatory Statement to the Tax Agent Services (Code of Professional Conduct) Determination 2024.