- Introduction

- Background

- Overview of the requirements

- The Code obligation

- Making or preparing (or permitting or directing another to make or prepare) false or misleading statements

- Preparing a statement that a registered tax practitioner knows, or ought reasonably to know, is likely to be made to the TPB, ATO or another Australian government agency by an entity

- That the registered tax practitioner knows, or ought reasonably to know, is false or misleading in a material particular, or omits any matter or thing without which the statement is misleading in a material respect, in their capacity as a registered tax practitioner or in any other capacity

- Required action after a false or misleading statement has been made to the TPB or ATO

- Reasonable period of time after the tax practitioner comes to believe the statement given was materially false or misleading

- Take all reasonable steps

- Actions that may be required to be taken

- Exceptions to the requirement under subsection 15(2) to take further action

- Statements made to other Australian government agencies

- Application of the Code obligation to more than one tax practitioner within the same entity

- Breach reporting obligations for registered tax practitioners

- Application date of the new requirements under section 15 of the Determination

- Other considerations – civil penalties and criminal liability for making false or misleading statements

- Civil penalty liability under the TASA

- Criminal liability under sections 8K and 8N of the TAA

- Penalties imposed by the ATO under Schedule 1 to the TAA

- Case studies

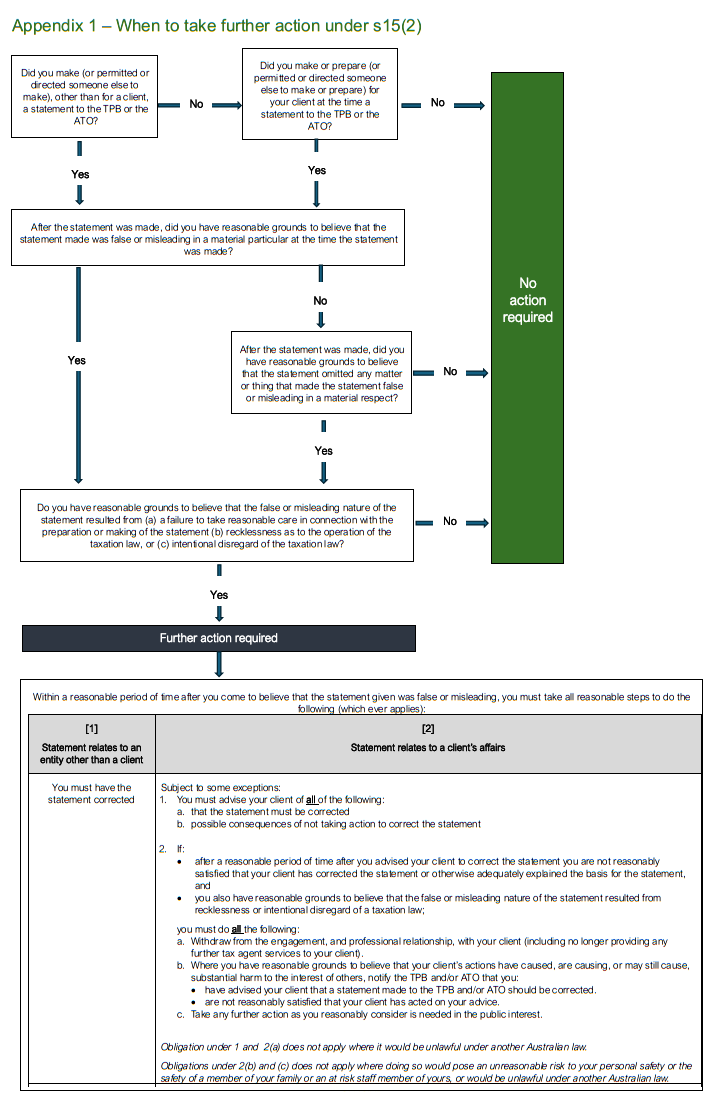

- Appendix 1 - When to take further action under s15(2)

- References

Disclaimer

This is a Tax Practitioners Board (TPB) Information sheet (TPB(I)).

This document is intended as information only. It provides information regarding the TPB’s position on the application of section 15 of Tax Agent Services (Code of Professional Conduct) Determination 2024 (Determination).

While this TPB(I) seeks to provide practical assistance and explanation, it does not exhaust, prescribe or limit the scope of the TPB’s powers in the Tax Agent Services Act 2009 (TASA). In addition, please note that the principles, explanations and examples in this TPB(I) do not constitute legal advice and do not create additional rights or legal obligations beyond those that are contained in the TASA or which may exist at law. Please refer to the TASA and the Determination for the precise content of the legislative requirements.

Document history

This TPB(I) was originally issued as an exposure draft on 24 October 2024. The TPB invited comments and submissions in relation to the information contained in it by 21 November 2024. The TPB considered all the comments and submissions received and published the TPB(I) on 23 December 2024.

This TPB(I) is based on the TASA as at the date of issue.

Issued: 23 December 2024.

Introduction

- This Information sheet (TPB(I)) has been prepared by the Tax Practitioners Board (TPB) to assist registered tax agents and BAS agents (collectively referred to as ‘registered tax practitioners’) to understand their obligations under section 15 of the Tax Agent Services (Code of Professional Conduct) Determination 2024 (Determination).

- While the focus of this TPB(I) is on the obligations in section 15 of the Determination, it is important to note that there are also 17 obligations in the Code of Professional Conduct (Code),[1] additional obligations in the Determination, and further requirements that registered tax practitioners must comply with under the Tax Agent Services Act 2009 (TASA). These include ongoing requirements in relation to maintaining registration under the TASA, including that a registered tax practitioner is a ‘fit and proper’ person.[2]

- In this TPB(I), you will find the following information:

- Background to the legislative requirements (paragraphs 4 to 9)

- Overview of the requirements (paragraphs 10 to 15)

- The Code obligation (paragraphs 16 to 39)

- Required action after a false or misleading statement has been made to the TPB or Australian Taxation Office (ATO) (paragraphs 40 to 136)

- Statements made to other Australian government agencies (paragraphs 137 to 139)

- Application of the Code obligation to more than one tax practitioner within the same entity (paragraph 140)

- Breach reporting obligations for registered tax practitioners (paragraphs 141 to 143)

- Application date of the new requirements under section 15 of the Determination (paragraph 144)

- Other considerations - civil penalties and criminal liability for making false or misleading statements (paragraphs 145 to 151)

- Case studies (paragraph 152)

- Appendix 1 – illustration of requirement to notify the TPB and ATO.

Background

- Section 30-10 of the TASA contains the Code, comprising 17 items which regulate the personal and professional conduct of all registered tax practitioners.

- One of these obligations is contained in subsection 30-10(17) of the TASA, which requires registered tax practitioners to comply with any obligations that the Minister determines, by legislative instrument, under section 30-12 of the TASA.

- On 1 July 2024, the Minister determined 8 additional Code obligations, set out in the Determination. These additional Code obligations apply from:

- Therefore, the obligations under section 15 of the Determination applies to false or misleading statements made on or after the relevant application date under paragraph 6.[5]

- The deferred application of the new obligations provides registered tax practitioners time to develop, implement and update systems and processes necessary to meet their obligations by commencement.

- For further information on the Determination, refer to the TPB’s website guidance titled The Code Determination – Background and context. This document provides additional background information including:

- the process to finalise the Determination

- commencement and application date

- the TPB’s approach to support implementation.

Overview of the requirements

Under subsection 15 of the Determination, a registered tax practitioner must not:

- make a statement to the Board, the Commissioner or other Australian government agency; or

- prepare a statement that you know, or ought reasonably to know, is likely to be made to the Board, Commissioner other Australian government agency by an entity; or

- permit or direct someone else to make or prepare such a statement;

that the registered tax practitioner knows, or ought reasonably to know, is false or misleading in a material particular, or omits any matter or thing without which the statement is misleading in a material respect, in their capacity as a registered tax practitioner or in any other capacity.

- Where a registered tax practitioner made a statement, or permitted or directed someone else to make the statement (other than for a client), or made or prepared a statement, or permitted or directed someone else to make or prepare the statement (for a client) that has been given to the Board or the Commissioner, and all the following apply:

- At a time after the statement was made the registered tax practitioner had reasonable grounds to believe that the statement:

- was either false or misleading in a material particular at the time the statement was made, or

- omitted a matter or thing, at the time it was made, that made the statement misleading in a material particular.

The registered tax practitioner had reasonable grounds to believe that the false or misleading nature of the statement resulted from:

- a failure to take reasonable care in connection with the preparation or making of the statement; or

- recklessness as to the operation of a taxation law; or

- intentional disregard of a taxation law

by the registered tax practitioner (or someone permitted or directed by the registered tax practitioner) or the client.

- At a time after the statement was made the registered tax practitioner had reasonable grounds to believe that the statement:

Within a reasonable period of time after the registered tax practitioner believes that the statement was materially false or misleading, the registered tax practitioner must respond and take the following actions, in Table 1, depending on their situation:

Table 1: reasonable step actions

Situation 1 Take reasonable steps to The registered tax practitioner made the statement or permitted or directed someone else to make the statement (other than a statement made for a client) Have the statement corrected. 2 Take reasonable steps to Where the registered tax practitioner made or prepared the statement, or permitted or directed someone else to make or prepare the statement, for a client Advise the client about all of the following:

a. that the statement should be corrected; and

b. the possible consequences of not taking action to correct the statement.

However, this item does not apply to the extent that doing so would be unlawful under another Australian law.

3 Take reasonable steps to Where:

a. the registered tax practitioner made or prepared the statement, or permitted or directed someone else to make or prepare the statement, for a client; and

b. after a reasonable period of time after taking the steps mentioned in item 2 of this table, the registered tax practitioner is not reasonably satisfied that the client has corrected the statement or otherwise adequately explained the basis for the statement; and

c. the false or misleading nature of the statement resulted from recklessness as to the operation of a taxation law or intentional disregard of a taxation law.

Withdraw from the engagement, and professional relationship, with the client (including no longer providing any further tax agent services to the client).

However, this item does not apply to the extent that:

- doing so would pose an unreasonable risk to the registered tax practitioner’s personal safety, or the safety of a member of their family or an at risk staff member; or

- doing so would be unlawful under another Australian law.

4 Take reasonable steps to Where:

a. the registered tax practitioner made or prepared the statement, or permitted or directed someone else to make or prepare the statement, for a client; and

b. after a reasonable period of time after taking the steps mentioned in item 2 of this table, the registered tax practitioner is not reasonably satisfied that the client has corrected the statement or otherwise adequately explained the basis for the statement; and

c. the false or misleading nature of the statement resulted from recklessness as to the operation of a taxation law or intentional disregard of a taxation law

d. the registered tax practitioner has reasonable grounds to believe the client's actions have caused, are causing, or may still cause, substantial harm to the interests of others (including investors, creditors, employees, or the public)

Notify the Board or Commissioner (as the case requires) that the registered tax practitioner has advised the client that a statement made to the Board or Commissioner should be corrected and they are not reasonably satisfied that their advice was acted upon.

However, this item does not apply to the extent that:

- doing so would pose an unreasonable risk to the registered tax practitioner’s personal safety, or the safety of a member of their family or an at risk staff member; or

- doing so would be unlawful under another Australian law.

Take any further action as the registered tax practitioner reasonably considers is needed in the public interest.

However, this item does not apply to the extent that:

- doing so would pose an unreasonable risk to the registered tax practitioner's personal safety, or the safety of a member of their family or an at risk staff member, or

- doing so would be unlawful under another Australian law.

Situation Take reasonable steps to 1 The registered tax practitioner made the statement or permitted or directed someone else to make the statement (other than a statement made for a client) Have the statement corrected. 2 Where the registered tax practitioner made or prepared the statement, or permitted or directed someone else to make or prepare the statement, for a client Advise the client about all of the following:

a. that the statement should be corrected; and

b. the possible consequences of not taking action to correct the statement.

However, this item does not apply to the extent that doing so would be unlawful under another Australian law.

3 Where:

a. the registered tax practitioner made or prepared the statement, or permitted or directed someone else to make or prepare the statement, for a client; and

b. after a reasonable period of time after taking the steps mentioned in item 2 of this table, the registered tax practitioner is not reasonably satisfied that the client has corrected the statement or otherwise adequately explained the basis for the statement; and

c. the false or misleading nature of the statement resulted from recklessness as to the operation of a taxation law or intentional disregard of a taxation law.

Withdraw from the engagement, and professional relationship, with the client (including no longer providing any further tax agent services to the client).

However, this item does not apply to the extent that:

- doing so would pose an unreasonable risk to the registered tax practitioner’s personal safety, or the safety of a member of their family or an at risk staff member; or

- doing so would be unlawful under another Australian law.

4 Where:

a. the registered tax practitioner made or prepared the statement, or permitted or directed someone else to make or prepare the statement, for a client; and

b. after a reasonable period of time after taking the steps mentioned in item 2 of this table, the registered tax practitioner is not reasonably satisfied that the client has corrected the statement or otherwise adequately explained the basis for the statement; and

c. the false or misleading nature of the statement resulted from recklessness as to the operation of a taxation law or intentional disregard of a taxation law

d. the registered tax practitioner has reasonable grounds to believe the client's actions have caused, are causing, or may still cause, substantial harm to the interests of others (including investors, creditors, employees, or the public)

Notify the Board or Commissioner (as the case requires) that the registered tax practitioner has advised the client that a statement made to the Board or Commissioner should be corrected and they are not reasonably satisfied that their advice was acted upon.

However, this item does not apply to the extent that:

- doing so would pose an unreasonable risk to the registered tax practitioner’s personal safety, or the safety of a member of their family or an at risk staff member; or

- doing so would be unlawful under another Australian law.

Take any further action as the registered tax practitioner reasonably considers is needed in the public interest.

However, this item does not apply to the extent that:

- doing so would pose an unreasonable risk to the registered tax practitioner's personal safety, or the safety of a member of their family or an at risk staff member, or

- doing so would be unlawful under another Australian law.

- A flowchart in respect of the obligation to take action in relation to a false or misleading statement given to the TPB or ATO is provided in Appendix 1 to this Information Sheet.

- Given the trust placed in registered tax practitioners, it is important that an appropriate balance is struck between their duties to their clients and their duties to support public trust and confidence in the integrity of the tax profession and tax system.

- Subsection 15(2) of the Determination reflects that a registered tax practitioner has an ethical responsibility to act in the public interest by notifying regulatory authorities of the conduct of a client where there is credible evidence of substantial harm to the material interests of the broader public from serious non-compliance of the tax laws by a client.

The Code obligation

Section 15 of the Determination provides that a registered tax practitioner must not:

- make a statement to the Board, the Commissioner or other Australian government agency; or

- prepare a statement that you know, or ought reasonably to know, is likely to be made to the Board, Commissioner or other Australian government agency by an entity; or

- permit or direct someone else to make or prepare such a statement;

that the registered tax practitioner knows, or ought reasonably to know, is false or misleading in a material particular, or omits any matter or thing without which the statement is misleading in a material respect, in their capacity as a registered tax practitioner or in any other capacity.

Making or preparing (or permitting or directing another to make or prepare) false or misleading statements

Make

- A registered tax practitioner will ‘make’ a statement if they prepare, draft or cause the statement to be made or if they permit or direct another person to make the statement. This includes statements made by or about the tax practitioner (or about the tax practitioner’s affairs) or on behalf of, or about, another entity (such as a client).

Statement

- Consistent with the concept of a ‘false or misleading statement’ in respect of the administration of penalties by the ATO under the Taxation Administration Act 1953 (TAA),[6] a statement for the purposes of the TASA is anything that is disclosed for a purpose connected with a taxation law orally or in writing (and includes those made electronically). A statement includes the following:

- statements made in correspondence, a registration and/or application form, any taxation document,[7] an activity statement, an amendment request or any other communication

- statements made by omission, if an entity fails to include material information in a document that requires that information to be supplied.

- Where a registered tax practitioner lodges a form, the form itself is not the statement that is made. The statement is the information at the individual labels, fields or questions, schedules or annexures. This means that a form can consist of more than one statement.

- A statement also includes statements made to the TPB, including:

- under the requirements to notify the TPB of a change in circumstance or a significant breach of the Code, contained in sections 30-35 and 30-40 of the TASA[8]

- in response to formal and informal information requests made by the TPB

- by registered tax practitioners through My Profile, for instance, in providing information relevant to a tax practitioner’s registration that may or may not be published on the TPB’s Public Register

- in any other communication.

- Failing to lodge or provide a statement to the TPB or ATO will not constitute making a false or misleading statement for the purposes of section 15, however may give rise to contraventions of other obligations under the TASA, Determination and tax laws more generally.

‘Permitting or directing’

- A registered tax practitioner will ‘permit or direct’ someone else to prepare a statement where they give permission to, allow, instruct, provide an opportunity to, or otherwise facilitate the preparation of the statement by that other person or entity.

TPB, ATO or Australian government agency

- In addition, these obligations will only apply where the statement is made to one of the following:

- the TPB

- the ATO

- another Australian government agency.[9]

Preparing a statement that a registered tax practitioner knows, or ought reasonably to know, is likely to be made to the TPB, ATO or another Australian government agency by an entity

- A registered tax practitioner will be taken to prepare a statement if they formulate, draft, or otherwise get it ready.

That a registered tax practitioner knows, or ought reasonably to know

- The phrase 'know or ought reasonably to know’ has two elements. The term ‘know’ refers to actual knowledge. The phrase ‘ought reasonably to know’ extends to ‘constructive knowledge’, where a person is taken to have knowledge about a matter, if the existence of that matter could be discovered by a reasonable and honest person in the same position as the person.[10]

Is likely to be made to the TPB, ATO or another Australian government agency by an entity

- The registered tax practitioner must have actual or constructive knowledge that the statement prepared is likely to be made to the TPB, ATO or another government agency by an entity.

- The obligation will not apply if a registered tax practitioner can demonstrate that the statement prepared was unlikely to be made to the TPB, ATO or another Australian government agency. This may include, for example:

- a statement prepared as part of an advice or some other document or communication which is unlikely to be made or provided to the TPB, ATO or another Australian government agency

- a statement prepared to be made to an entity other than the TPB, ATO or another Australian government agency.

Permitting or directing someone else to make or prepare such a statement

- A statement to the TPB, ATO or another Australian government agency will also be caught if a registered tax practitioner permits or directs someone else to make or prepare such a statement. This could include, for example:

- statements that a registered tax practitioner permits to be made by individuals working under the supervision and control of the registered tax practitioner

- statements that a registered tax practitioner directs another individual (such as another registered tax practitioner, a client, employee or any other person) to make.

That the registered tax practitioner knows, or ought reasonably to know, is false or misleading in a material particular, or omits any matter or thing without which the statement is misleading in a material respect, in their capacity as a registered tax practitioner or in any other capacity

- This second component of the requirement under subsection 15(1) of the Determination includes the following three elements:

- the registered tax practitioner knows or ought reasonably to know

- that the statement is false or misleading in a material particular, or omits any matter or thing without which the statement is misleading in a material respect

- in their capacity as a registered tax practitioner or in any other capacity.

Registered tax practitioner knows or ought reasonably to know

- The phrase ‘knows or ought reasonably to know’ includes actual and constructive knowledge. The nature of constructive knowledge is that the registered tax practitioner will be taken to have the knowledge of matters that, a reasonable and honest tax practitioner in their position will have in the circumstances.[11]

- Whether an honest and reasonable tax practitioner in the same circumstances as a registered tax practitioner will have constructive knowledge of a matter should be considered in the context of the professional and ethical obligations that all registered tax practitioners must comply with under the TASA, including the Code - for example:

- Code item 7 under subsection 30-10(7) of the TASA requires registered tax practitioners to ensure that the tax agent services they provide or that are provided on their behalf are provided competently[12]

- Code item 9 under subsection 30-10(9) of the TASA requires registered tax practitioners to take reasonable care to ascertain a client’s state of affairs,[13] and

- Code item 10 under subsection 30-10(10) of the TASA requires registered tax practitioners to take reasonable care to ensure that the taxation laws are applied correctly to the circumstances in relation to which advice is being provided to a client.[14]

- It follows that the appropriate skill, ethical attributes, judgement and knowledge expected and required of registered tax practitioners will inform the matters about which a registered tax practitioner will be considered to have constructive knowledge in the circumstances.

Statement is false or misleading in a material particular, or omits any matter or thing without which the statement is misleading in a material respect

- The obligation under subsection 15(1) of the Determination is limited to statements that are false or misleading in a material particular, or omit any matter or thing without which the statement is misleading in a material respect.

- The nature of this obligation is one of truthfulness and integrity.[15] The provision is concerned with particulars that are material in nature. This means that false or misleading particulars that are minor, insignificant, immaterial or trivial in the circumstances will not constitute a breach of section 15 of the Determination.[16]

The concepts of ‘false statements’, ‘misleading statements’ and ‘material particulars’ are further explained below.

False statements

- a statement is false if it is contrary to fact or wrong

- a statement may be false because of something contained in the statement or because something is omitted from the statement

- if a statement was correct at the time it was made but is subsequently made incorrect because of a retrospective amendment to the law, it is not later considered false (or misleading).

Misleading statements

- a statement is misleading if it creates a false impression

- it may be misleading because of something contained in the statement or because of something omitted from the statement

- the reason the statement is misleading may be because it is uninformative, unclear or deceptive.

In a material particular

- The leading case on the meaning of ‘material particulars’ or ‘material respects’ in relation to false or misleading statements is Minister for Immigration, Local Government and Ethnic Affairs v Dela Cruz (1992) 34 FCR 348. In that case, the Full Federal Court held that, in relation to section 234 of the Migration Act 1958, the term ‘material’, being an expression appearing in many statutes, both in Australia and overseas, requires no more and no less than that; the false or misleading particular must be of moment or of significance, not merely trivial or inconsequential. A statement will be false or misleading in a material particular if it is relevant to the purpose for which it is made and relevant to that purpose if it may, not only if it must or if it will, be taken into account in making a decision under the Act.

- A statement or particular will be ‘material’ where it is relevant to the purpose for which it is made,[17] for example, if it will be taken into account by a decision-maker (regardless of whether it is required to be taken into account under the relevant statute), when making a decision to which the statement or particular relates.[18]

- To be material the false or misleading particular must be of moment or significance, not merely trivial or inconsequential.[19]

- Whether the false or misleading statement is ‘material’ will depend on the facts and circumstances, and whether a reasonable person, having the knowledge, skill and experience of a registered tax practitioner, would expect the misstatement or omission to be of substantial import, effect or consequence to the outcome for which it was given.[20]

- A statement may be false or misleading in a material particular regardless of whether the maker of the statement knew at the time of making the statement, that the particular is material.[21]

- Materiality is determined at the time the statement is made - a statement cannot be made material because of subsequent events.[22]

- However, materiality may be unknown until a subsequent event occurs or further evidence comes to light which reveals that the statement was false or misleading in a material particular at the time it was made.[23]

- The obligation under subsection 15(1) of the Determination extends to the omission of any matter or thing without which the statement is misleading in a material respect. Whether or not the particular is misleading in a material respect will depend on the circumstances, and whether a reasonable person, having the knowledge, skill and experience of a registered tax practitioner, would expect the misstatement or omission to be of substantial import, effect or consequence to the outcome for which it was given. This requires the registered tax practitioner to exercise their professional judgement, taking into account the facts and circumstances of their client and those surrounding the making, or preparing, of the statement.

- The concept of ‘materiality’ under section 15 of the Determination is consistent with the approach under the APES 220 Taxation Services, which excludes certain obligations for members in relation to making false or misleading statements, where the false or misleading information in question is immaterial or inconsequential in nature.[24]

In their capacity as a registered tax practitioner or in any other capacity

- The obligation under subsection 15(1) of the Determination extends to statements a registered tax practitioner makes, prepares, or permits or directs someone else to make or prepare in their capacity as a registered tax practitioner or in any other capacity.

- ‘Any other capacity’ means any capacity other than an entity’s capacity as a registered tax practitioner and includes personal capacity.

Required action after a false or misleading statement has been made to the TPB or ATO

- Subject to some exceptions (see paragraph 126 onwards) registered tax practitioners will be required to take further action in respect of false or misleading statements made (outlined in Table 2 in paragraph 41 below), when all the elements listed in Table 2 in paragraph 41 have been satisfied.

There are a number of key concepts and phrases which are defined and explained further in this TPB(I).

Table 2: Elements that must be satisfied before further action is required in respect of a false or misleading statement made

Element 1 Explanation of Element A statement has been given to the TPB or ATO - The statement must actually have been given to the TPB or ATO.

- The obligation will not arise if the statement has merely been prepared but not given to the TPB or ATO.

- The obligations to take further action only apply to false or misleading statements given to the TPB or ATO, and not to statements given to any other entity, including another Australian government agency (although this may have other consequences for registered tax practitioners).

2 Explanation of Element One of the following applies:

- the registered tax practitioner made the statement, or permitted or directed someone else to make the statement, other than for a client, or

- for an entity that was a client of the registered tax practitioner at the time the statement was given to the TPB or ATO, the registered tax practitioner made or prepared the statement, or directed someone else to make or prepare the statement.

This element will be satisfied if:

- in relation to a statement for an entity other than a client – the registered tax practitioner made the statement or permitted or directed someone else to make the statement. This could include a statement made by a registered tax practitioner for themself.

- in relation to a statement for a client – the registered tax practitioner made or prepared the statement, or permitted or directed someone else to make or prepare the statement.

3 Explanation of Element At a time after the statement was made, the registered tax practitioner has reasonable grounds to believe that the statement:

- was false or misleading in a material particular at the time it was made, or

- omitted any matter or thing, at the time it was made, without which the statement at that time is misleading in a material respect.

- Subsequent to the statement being made to the TPB or ATO, the registered tax practitioner must have reasonable grounds to believe that the statement was false or misleading (including by omission) in a material particular at the time it was made.

4 Explanation of Element The registered tax practitioner also has reasonable grounds to believe that the false or misleading nature of the statement resulted from:

- a failure to take reasonable care in connection with the preparation or making of the statement, or

- recklessness as to the operation of a taxation law, or

- intentional disregard of a taxation law

by the registered tax practitioner (or someone permitted or directed by the registered tax practitioner) or the client.

- The registered tax practitioner must have reasonable grounds to believe that the false or misleading nature of the statement resulted from one of the 3 specified reasons.

- This element will not be satisfied if the registered tax practitioner has reasonable grounds to believe that the false or misleading nature of the statement resulted from some other reason – for example, the registered tax practitioner has a reasonable belief that reasonable care was taken in the circumstances.

- The false or misleading nature of the statement can be from the tax practitioner about their own affairs, from the tax practitioner making or preparing the statement on the client’s behalf, or from the client about the client’s affairs.

Element Explanation of Element 1 A statement has been given to the TPB or ATO - The statement must actually have been given to the TPB or ATO.

- The obligation will not arise if the statement has merely been prepared but not given to the TPB or ATO.

- The obligations to take further action only apply to false or misleading statements given to the TPB or ATO, and not to statements given to any other entity, including another Australian government agency (although this may have other consequences for registered tax practitioners).

2 One of the following applies:

- the registered tax practitioner made the statement, or permitted or directed someone else to make the statement, other than for a client, or

- for an entity that was a client of the registered tax practitioner at the time the statement was given to the TPB or ATO, the registered tax practitioner made or prepared the statement, or directed someone else to make or prepare the statement.

This element will be satisfied if:

- in relation to a statement for an entity other than a client – the registered tax practitioner made the statement or permitted or directed someone else to make the statement. This could include a statement made by a registered tax practitioner for themself.

- in relation to a statement for a client – the registered tax practitioner made or prepared the statement, or permitted or directed someone else to make or prepare the statement.

3 At a time after the statement was made, the registered tax practitioner has reasonable grounds to believe that the statement:

- was false or misleading in a material particular at the time it was made, or

- omitted any matter or thing, at the time it was made, without which the statement at that time is misleading in a material respect.

- Subsequent to the statement being made to the TPB or ATO, the registered tax practitioner must have reasonable grounds to believe that the statement was false or misleading (including by omission) in a material particular at the time it was made.

4 The registered tax practitioner also has reasonable grounds to believe that the false or misleading nature of the statement resulted from:

- a failure to take reasonable care in connection with the preparation or making of the statement, or

- recklessness as to the operation of a taxation law, or

- intentional disregard of a taxation law

by the registered tax practitioner (or someone permitted or directed by the registered tax practitioner) or the client.

- The registered tax practitioner must have reasonable grounds to believe that the false or misleading nature of the statement resulted from one of the 3 specified reasons.

- This element will not be satisfied if the registered tax practitioner has reasonable grounds to believe that the false or misleading nature of the statement resulted from some other reason – for example, the registered tax practitioner has a reasonable belief that reasonable care was taken in the circumstances.

- The false or misleading nature of the statement can be from the tax practitioner about their own affairs, from the tax practitioner making or preparing the statement on the client’s behalf, or from the client about the client’s affairs.

- When all the above elements have been satisfied, registered tax practitioners are required to take further action as outlined in Table 1 above, within a reasonable period of time after the registered tax practitioner comes to believe that the statement given was materially false or misleading.

- Innocent or genuine errors or mistakes of registered tax practitioners and their clients are not intended to be captured by the above obligations. The threshold for required further action (outlined above) aligns with the administrative penalty regime under the taxation law, relating to statements that have been made without reasonable care, recklessly or with intentional disregard of the taxation laws. Examples of false or misleading statements that would not require further action may include:

- information reported at incorrect labels in a statement or return, that results in minimal or no change to the overall tax position of the client

- typographical errors

- genuine mistakes that have occurred due to minor misunderstandings of a client’s situation or the application of a tax law.

- While subsection 15(2) does not require registered tax practitioners to take action in relation to a statement that was not false or misleading at the time it was made, but later becomes false or misleading because of some later event, registered tax practitioners must ensure that subsequent statements made to the TPB or ATO are not false or misleading in a material particular, and must comply with all other obligations under the TASA, for example, the requirement to notify the TPB about changes in circumstances[25] and breach reporting.[26]

- The requirements to take further action after a false or misleading statement has been made apply regardless of how the registered tax practitioner becomes aware of the false or misleading statement. For example, if a registered tax practitioner becomes aware that a false or misleading statement has been made due to notification by the ATO, the registered tax practitioner will still be required to take further action as required by subsection 15(2), including the notification requirements (if applicable).

- These obligations support registered tax practitioners in being accountable and taking steps to assist the TPB and ATO in ensuring that they have access to the most accurate information. This action also displays the goodwill of the registered tax practitioner and may be factored into any potential sanctions pursued by the TPB for breach of the Code.

- These obligations have been informed by the standards issued by the Accounting Professional & Ethical Standards Board (APESB).[27]

Reasonable period of time after the tax practitioner comes to believe the statement given was materially false or misleading

- Subsection 15(2A) of the Determination states that in determining what is a reasonable period of time, registered tax practitioners should have regard to:

- the nature of the statement (for example, the entitlement or obligation that the false or misleading statement relates to)

- the circumstances of the client (for example, any practical issues with advising the client to correct the statement or taking further action as required, for example if the client is overseas, unwell or uncontactable)

- the details that were false or misleading (for example, how complex the matter that the statement relates to is and/or how easily the statement can be corrected, or further action can be taken by the registered tax practitioner and/or client)

- how long ago the statement was made

- the relevant period of review

- any timeframe set out in a taxation law for the lodgement of the statement or a correction to the statement[28]

- any other relevant matter.

Take all reasonable steps

- Depending on the circumstances that have occurred, registered tax practitioners must take all reasonable steps to take further action, as described in Table 1 above. Determining what is required for the purposes of taking ‘all reasonable steps’ will vary, depending on the circumstances. For example, the appropriate and reasonable steps to correct a statement (not made for a client) will vary depending on what the statement is, and how the TPB or ATO (whichever is relevant) requires corrections to statements of its nature. For example, an amendment to an income tax return will require registered tax practitioners to follow the ATO’s processes and timeframes for amending returns.

- Where a registered tax practitioner is unable to take the necessary course of action (set out in Table 1 above) despite, in their view, taking all reasonable steps, the registered tax practitioner should document the steps they undertook in attempting to take the necessary course of action as required under subsection 15(2) of the Determination. The importance in documenting the steps undertaken is that it will be a mitigating factor the TPB considers in determining what compliance action to take (if any).

- The key elements of the obligations to take further action in respect of a false or misleading statement under subsection 15(2) of the Determination are explained further below.

Actions that may be required to be taken

- In responding to a false or misleading statement, depending on the situation, registered tax practitioners must take reasonable steps to take at least one of the following actions (further details of these actions are explained below):

- Have the statement corrected.

- Advise the client to which the statement relates that the statement should be corrected and the possible consequences of not taking action to correct the statement.

- Withdraw from the engagement and professional relationship with the client.

- Notify the TPB or ATO (as the case requires).

- Take any further action reasonably considered needed in the public interest.

Have the statement corrected (statements that were not made by, or for, a client)

- The obligation for registered tax practitioners to have a statement corrected under subsection 15(2) of the Determination will arise where:

- all the elements in Table 2 in paragraph 41 above are satisfied, and

- the registered tax practitioner made the statement, or permitted or directed someone else to make the statement, for an entity other than their client.

- This could arise where the registered tax practitioner has made the statement for themselves, or for any other entity provided that entity is not a client.

- The obligation to have the statement corrected does not require that the registered tax practitioner make the correction themself. The registered tax practitioner can arrange to have the correction made for them.

- For statements provided to the ATO, where an amendment or correction is required after a statutory time limit has passed, the registered tax practitioner should consider whether it is appropriate to request an extension of time to lodge an objection, which will allow the false or misleading statement to be corrected. However, in circumstances where there has been fraud or evasion, there will be an indefinite amendment period.[29]

Advise the client to which the statement relates that the statement should be corrected and the possible consequences of not taking action to correct the statement

- The obligation for registered tax practitioners to advise their client to which the statement relates that the statement should be corrected under subsection 15(2) of the Determination will arise (subject to the exception explained in paragraph 126 onwards) where:

- all the elements in Table 2 in paragraph 41 above are satisfied, and

- the registered tax practitioner made or prepared the statement, or permitted or directed someone else to make or prepare the statement for a client.

- Importantly, the requirement to advise about a correction under this provision only relates to statements that are made or prepared for a client.

- Not only must registered tax practitioners in these circumstances advise their clients that the statement should be corrected, they must also advise the client about the possible consequences of not taking action to correct the statement. Such consequences of not taking action includes any consequences that may arise for breaching relevant laws, including any fines, penalties or other liability that could arise in connection with the false or misleading statement.

- In some circumstances, it may be appropriate for the registered tax practitioner’s advice to the client to reference the requirements of the registered tax practitioner if they are not reasonably satisfied that the client has corrected the statement or otherwise adequately explained the basis for the statement, to:

- withdraw from the engagement, and professional relationship, with the client (including no longer providing any further tax agent services to the client), and

- in certain circumstances, notifying the TPB or ATO (as the case requires) that the registered tax practitioner is not reasonably satisfied that the registered tax practitioner’s advice to the client that the statement should be corrected has been acted upon, and

- taking any further action as the registered tax practitioner reasonably considers is needed in the public interest.

- In considering whether to reference the registered tax practitioner’s above obligations to take further action, registered tax practitioners should have regard to their obligations to inform clients of matters under section 45 of the Code Determination.[30] In particular, this includes the registered tax practitioner’s rights, responsibilities and obligations as a tax or BAS agent, under the taxation laws, including the TASA and the Code.

- The registered tax practitioner may also wish to advise or recommend to the client that the registered tax practitioner can correct the statement on the client’s behalf, and seek the client’s authorisation and/or instructions to do so (including agreement of any fees or other terms that may be applicable for the registered tax practitioner doing so).

- It will be a matter for the registered tax practitioner to decide how they advise their client for the purposes of this requirement. However, the TPB recommends that the advice to the client be in writing, clear and unambiguous.

- If, given the nature of the registered tax practitioner’s relationship with the client, the registered tax practitioner verbally advises the client that the statement should be corrected, it is recommended that the registered tax practitioner confirms the advice provided in writing (for example, through email or letter), or at the very least, keep a file note recording the verbal advice provided.

- Registered tax practitioners should also be aware of their other obligations under the Code, including for example, Code item 12 (advising clients about their rights and obligations under the taxation laws that are materially related to the tax agent services provided), and Code item 7 (providing tax agent services to a competent standard). Further information on these Code items, and all obligations under the Code, can be found in TPB(EP) 01/2010 Code of Professional Conduct.

Withdraw from the engagement and professional relationship with the client

- The obligation for registered tax practitioners to withdraw from the engagement with the client will arise where all of the following are satisfied (subject to the exceptions explained in paragraph 126 onwards):

- all the elements in Table 2 in paragraph 41 above are met, and

- the registered tax practitioner made or prepared the statement, or permitted or directed someone else to make or prepare the statement for a client, and

- after a reasonable period of time after advising their client that the statement should be corrected, the registered tax practitioner is not reasonably satisfied that their client has corrected the statement or otherwise adequately explained the basis for the statement, and

- the registered tax practitioner has reasonable grounds to believe that the false or misleading nature of the statement resulted from recklessness or intentional disregard of a taxation law by the registered tax practitioner (or someone permitted or directed by the registered tax practitioner) or the client.

- How the tax practitioner withdraws from the engagement and professional relationship with the client will depend on the contractual relationship between the registered tax practitioner and the client. As such, registered tax practitioners are advised to ensure that their engagement letters and/or other contractual arrangements enable the registered tax practitioner to fulfil their obligations under subsection 15(2) of the Determination, should the need arise. Registered tax practitioners may wish to seek legal advice in this regard.

- Not only are registered tax practitioners required to withdraw from their engagement in providing tax agent services (including BAS services) to the client, they must also withdraw from their professional relationship with the client. This means that the registered tax practitioner must withdraw from any other professional relationship they have with the client outside of the provision of tax agent services. For example, if the registered tax practitioner also provides business advisory, accounting, audit and/or financial services to the client, the registered tax practitioner must also withdraw the engagement in connection with the provision of these services.

- Relevantly, the requirement to withdraw is limited to the registered tax practitioner engaged to provide services to the client. For example, in the case of a multi-disciplinary partnership that is a registered tax practitioner engaged to provide services, the obligation to withdraw will apply to the partnership.

- If the registered tax practitioner is required to withdraw from their engagement and/or professional relationship with a client under subsection 15(2) of the Determination, this obligation to withdraw will not extend to related entities of the client, that the registered tax practitioner is engaged by or has a professional relationship with. The obligation to withdraw attaches to the client that has not corrected the false or misleading statement or has not adequately otherwise explained the basis for the statement. For example, where a registered tax practitioner has been engaged by a group representing a number of taxpayers or entities, the ‘client’ for the purposes of the obligations under subsection 15(2) of the Determination will be the entity about which the false or misleading statement in question relates. Notwithstanding this, registered tax practitioners should be alert to all their obligations under the TASA in determining whether to engage, or continue to engage, with a particular client.

Notify the TPB or ATO (as the case requires)

- The obligation for registered tax practitioners to notify the TPB or ATO (as the case requires) that they have advised the client that a statement made should be corrected, and the registered tax practitioner is not reasonably satisfied that the advice was acted upon will arise where all of the following are satisfied (subject to the exceptions explained in paragraph 126 onwards):

- all the elements in Table 2 in paragraph 41 above are met

- the registered tax practitioner made or prepared the statement, or permitted or directed someone else to make or prepare the statement for a client

- after a reasonable period of time after advising their client that the statement should be corrected, the registered tax practitioner is not reasonably satisfied that their client has corrected the statement or otherwise adequately explained the basis for the statement the registered tax practitioner has reasonable grounds to believe that the false or misleading nature of the statement resulted from recklessness or intentional disregard of a taxation law

- the registered tax practitioner has reasonable grounds to believe the client's actions have caused, are causing, or may still cause, substantial harm to the interests of others (including investors, creditors, employees or the public).

- Where the tax practitioner is obliged to notify the TPB or the ATO (as the case requires), the registered tax practitioner is not required to correct the statement or explain to the TPB or the ATO why they believe the statement to be false or misleading or what the registered tax practitioner otherwise believes the statement should have said. It is for the relevant regulatory authority to consider the notification (being a piece of intelligence and simply a concern, of an ethical nature, of the registered tax practitioner about their client’s potential compliance with one or more tax laws), and consider, what, if any, mitigation is required.[31]

- When notifying the TPB or ATO under this requirement, registered tax practitioners are required to advise the TPB or ATO (as appropriate):

- the client’s full legal name and any other identifying information, as considered appropriate in the circumstances

- that the notification is being made pursuant to section 15 of the Determination

- confirmation that the registered tax practitioner has advised their client that a statement made to the TPB or ATO should be corrected and they are not reasonably satisfied that this advice was acted upon

- relevant and sufficient information that would assist the TPB or ATO in their assessment of the potential false or misleading statement and decide if any mitigation is required. This means that a registered tax practitioner would need to provide the TPB or ATO with enough specific information to assess if a false or misleading statement has been made. For example, the relevant statement is contained in the 2022-23 company income tax return or the business activity statement for March 2024. Section 15 does not limit registered tax practitioners from providing additional information if they reasonably believe it is in the public interest to do so.

- In some circumstances, reporting registered tax practitioners may be eligible for the tax whistleblower protections that commenced from 1 July 2024, introduced by the Treasury Laws Amendment (Tax Accountability and Fairness) Act 2024. These changes provide protections for disclosures by eligible whistleblowers to the TPB relating to the misconduct of registered tax practitioners. Eligible whistleblowers will have their identity protected from disclosure, unless it is to an authorised body, or with the whistleblower’s consent. Further information about whistleblower protections can be found on the TPB’s website at www.tpb.gov.au/whistleblower-legislation.

- The appropriate manner in which the registered tax practitioner notifies the TPB or ATO will depend on the nature of the false or misleading statement originally made to the TPB or ATO.

- The method and process to notify the TPB and ATO will be published on the website of each agency.

Take any further action as reasonably considered is needed in the public interest

- The obligation for registered tax practitioners to take any further action as they reasonably consider is needed in the public interest will arise where all of the following are satisfied (subject to the exceptions explained in paragraph 126 onwards):

- all the elements in Table 2 in paragraph 41 above are met

- the registered tax practitioner made or prepared the statement, or permitted or directed someone else to make or prepare the statement for a client

- after a reasonable period of time after advising their client that the statement should be corrected, the registered tax practitioner is not reasonably satisfied that their client has corrected the statement or otherwise adequately explained the basis for the statement

- the registered tax practitioner has reasonable grounds to believe that the false or misleading nature of the statement resulted from recklessness or intentional disregard of a taxation law by the registered tax practitioner (or someone permitted or directed by the registered tax practitioner) or the client

- the registered tax practitioner has reasonable grounds to believe the client’s actions have caused, are causing, or may still cause, substantial harm to the interests of others (including investors, creditors, employees or the public).

- Having regard to the ordinary meaning[32] of the terms ‘reasonable’ and ‘consider’, the phrase ‘reasonably consider’ requires the registered tax practitioner to have sound and sensible basis for regarding or deciding that further action is needed, in the public interest.

- ‘Public interest’, while not being defined in the TASA or the Determination, is a concept frequently used in legislative settings. The consideration of what is in the public interest can be far reaching and broad. However, in the context of a registered tax practitioner’s obligations under the Determination and the TASA, what is in the ‘public interest’ will be constrained to matters that are relevant to supporting the public trust and confidence in the integrity of the tax profession and of the tax system by ensuring that tax agent services are provided to the community in accordance with appropriate standards of professional and ethical conduct.[33]

- Further action for the purposes of this obligation may include (but is not limited to) the following:

- providing additional information or material to the TPB or ATO to assist them in taking the appropriate action in response to the notification[34]

- providing relevant information to other regulatory or law enforcement agencies, for example, the Australian Securities and Investments Commission (ASIC) or police

- alerting the registered tax practitioner’s professional association about the general circumstances or issues

- advising another registered tax practitioner who is subsequently engaged by the client and seeks information and/or assurances from the registered tax practitioner in respect of the tax affairs of the client (for example, through an ethical letter)[35]

- responding to requests for information or documents from the TPB or ATO.

- This obligation is representative of the important role that registered tax practitioners play in the overall trust and confidence that the public places in the tax profession and tax system. Consistent with the obligation in Code item 4, which requires registered tax practitioners to act lawfully in the best interests of their clients, it is recognised that in some circumstances there may be a tension between acting in accordance with a client’s instructions and/or interests, and the registered tax practitioner’s own legal and ethical obligations. In these circumstances, registered tax practitioners are required to uphold their own legal and ethical obligations, even if doing so is contrary to their clients’ wishes or interests. Subject to some exceptions (see paragraph 126 onwards), this obligation will apply regardless of whether a client or former client permits or consents to the registered tax practitioner notifying the TPB or ATO about the false or misleading statement.

- Further, registered tax practitioners notifying the TPB or ATO that a statement previously provided to the TPB or ATO is false or misleading in a material particular, or notifying another registered tax practitioner in response to an ethical letter (where the registered tax practitioner reasonably considers it is needed in the public interest) will not be in contravention of the confidentiality requirements in Code item 6 under subsection 30-10(6) of the TASA[36] because registered tax practitioners have a legal duty to take such action under subsection 15(2) of the Determination.

- This is subject to any information, including client information, being protected by legal professional privilege (LPP). LPP protects confidential communications between a qualified legal advisor and their client from compulsory production where they were made for the dominant purpose of seeking legal advice, or for use in existing or anticipated litigation. LPP does not attach to all communications between a qualified legal advisor or their client. For example, LPP does not extend to communications in furtherance of an illegal or improper purpose. Once waived, LPP cannot be restored and may be lost permanently. Waiver may occur by way of widely distributing a confidential legal advice to different third parties or in communications that refer to and/or disclose the content or essence of the legal advice.

- The TASA, including the obligations under section 15 of the Determination, does not override the law relating to LPP.[37] As such, registered tax practitioners should consider whether LPP applies before providing information to the TPB, ATO or other entities (for example, registered tax practitioners, professional associations, regulatory or law enforcement agencies), and if so, they have a duty to consult their client as to whether the client wishes to waive their right to LPP in order to provide the information to the third party.

- If registered tax practitioners are unsure how the law relating to LPP applies, it would be prudent for them to seek legal advice.

- The elements, situations and obligations listed in Table 1 and Table 2 (in paragraph 41) above contain a number of key terms and phrases that are explained in further detail below.

Reasonable grounds to believe

- The obligations under subsection 15(2) of the Determination arise where, amongst other matters, the registered tax practitioner has:

- ‘reasonable grounds to believe’ that a statement made to the TPB or ATO was false or misleading in a material particular at the time that it was made (or omitted any matter or thing at the time it was made, without which the statement was misleading in a material respect); and

‘reasonable grounds to believe’ that the false or misleading nature of the statement resulted from:

- a failure to take reasonable care in connection with the preparation or making of the statement; or

- recklessness as to the operation of a taxation law; or

- intentional disregard of a taxation law

by the registered tax practitioner (or someone permitted or directed by the registered tax practitioner) or the client.

- The phrase ‘reasonable grounds to believe’ is not defined, or otherwise explained, in the TASA. As a result, it is given its ordinary meaning, having regard to the purpose of the provision and its statutory context.

- As discussed below, what constitutes ‘reasonable grounds to believe’ in any given scenario will ultimately depend on the facts and circumstances and must be considered on a case-by-case basis.

- Having regard to the ordinary meaning[38] of these terms, the phrase ‘reasonable grounds to believe’ requires the registered tax practitioner to have a sound foundation or basis in the circumstances on which to credit or form their belief.

- Further, it is established in case law that when legislation uses the term ‘reasonable grounds’ to describe a basis for a state of mind, for example, in forming a belief about a matter, there needs to be an existence of facts which are sufficient to induce that state of mind in a reasonable person.[39] Whether a person has reasonable grounds for a belief is an objective test, and it is irrelevant whether the person subjectively believes they have reasonable grounds. A ‘reasonable belief’ is a term that has been used in some criminal jurisdictions and is generally considered to infer a higher threshold than a ‘reasonable suspicion’.[40]

- For a registered tax practitioner to have ‘reasonable grounds to believe’ a matter, the foundation or basis for the belief does not need to be established to a high evidentiary standard. This means there does not have to be conclusive proof. It is sufficient if a reasonable person, possessing the required knowledge, skill and experience of a registered tax practitioner would, when objectively considered, form the belief on the same grounds in the same circumstances.

- Making such a determination will depend on an analysis of the surrounding circumstances and consideration of a number of factors, including but not limited to:

- the source of the information forming the basis of the belief and the credibility and reliability of that source/information

- whether there is independent evidence, verification or corroboration to support the belief

- the circumstances in which the registered tax practitioner became aware of the possibility that the statement is false or misleading and/or that the false or misleading nature of the statement resulted from recklessness or an intentional disregard of a taxation law by the registered tax practitioner (or someone permitted or directed by the registered tax practitioner) or the client

- whether, and to what extent, the registered tax practitioner made reasonable enquiries or sought advice to confirm their belief

- whether there are any reasonable alternative explanations that could counter the registered tax practitioner’s belief.

Reasonable care in connection with the preparation or making of the statement

- There is no set formula for determining what it means to take reasonable care in any given situation, including in connection with the preparation or making of a statement. Rather, whether a registered tax practitioner has taken reasonable care in a given situation will depend on an examination of all the circumstances,[41] including:

- the nature and scope of the statement

- if the statement is being made or prepared for a client

- the client’s circumstances and the circumstances surrounding the client making the statement

- the client’s level of professional knowledge and experience.

- The standard of ‘reasonable care’ generally required of registered tax practitioners is that of a competent and reasonable person, possessing the knowledge, skills, qualifications and experience that a registered tax practitioner is expected to have, in the circumstances.

- The obligation to take reasonable care does not mean that the care taken needs to be perfect or to the highest level of care possible. It is sufficient that the registered tax practitioner acts in a way that is consistent with how a reasonable person, possessing the required knowledge, skill and experience of a registered tax practitioner, objectively determined, would act in connection with making, preparing or directing or permitting someone else to make or prepare, the statement.

- Similarly for a client, a lack of reasonable care will be determined having regard to how a reasonable person, in the same circumstances as the client, would act in connection with making the statement, or engaging and/or instructing a registered tax practitioner to make or prepare the statement on their behalf. For unsophisticated clients, the level of reasonable care expected of the client will be of a lesser standard than that of a registered tax practitioner.

- If a statement prepared by a registered tax practitioner for a client seems credible (and for existing clients contained information that is consistent with what has been included in previous statements) and the registered agent has no basis on which to doubt the information supplied, the registered tax practitioner will have exercised reasonable care by accepting the statement (and information contained within the statement) provided by the client without further checking.

- In this case, the registered tax practitioner is not just accepting what the client tells them or gives them at face value. Rather, the registered tax practitioner is exercising their professional judgment based on the information previously provided by the client and the nature of the client themselves, and making a decision that further checking is not required in the particular circumstances.

- On the other hand, if the information supplied by a client for the purposes of preparing or making a statement does not seem credible (in accordance with how a competent and reasonable person, possessing the knowledge, skills, qualifications and experience of a registered tax practitioner, objectively determined, would perceive the information) or appears to be inconsistent with a previous pattern of claim or statement, further enquiries would be required, having regard to the terms of the engagement with the client.

- In such situations, taking reasonable care will mean that a registered tax practitioner will need to ask questions of their clients or examine the client’s records, or both, based on a reasonable registered tax practitioner’s professional knowledge, skills and experience in seeking information.

- Some other circumstances in which there may be a need to make further enquiries of the client in order to take reasonable care, include:

- new or substantial changes in the law

- nature and circumstances of the client, including whether a new or experienced client

- changes to the client’s circumstances relating to the statement being made or prepared

- unusual transactions in the context of the regular business of the client.

- Further information about what it means to take reasonable care can be found in the TPB’s Information Sheets TPB(I) 17/2013 Code of Professional Conduct – Reasonable care to ascertain a client’s state of affairs and TPB(I) 18/2013 Code of Professional Conduct – Reasonable care to ensure taxation laws are applied correctly.

Recklessness as to the operation of a taxation law

- ‘Recklessness’ is not defined, or otherwise explained, in the TASA. As a result, it is given its ordinary meaning, having regard to the purpose of the provision and its statutory context.

- As discussed below, what constitutes ‘recklessness’ in any given scenario will ultimately depend on the facts and circumstances and must be considered on a case-by-case basis.

- Having regard to the ordinary meaning[42] of this term and in the context of the provision of tax agent services, recklessness is behaviour which falls significantly short of the standard of care expected of a reasonable person in the same circumstances as the entity. It goes beyond a failure to take reasonable care, and will generally involve gross carelessness.

- Recklessness as to the operation of a taxation law in the context of making or preparing a statement (or directing or permitting someone to make or prepare a statement) is behaviour that demonstrates a disregard of the risk or indifference to the consequences that are foreseeable by a reasonable person. However, the entity does not need to actually realise the likelihood of the risk for it to be reckless.[43]

- Similar to the test for determining whether reasonable care has been taken, a finding of recklessness depends on the application of an essentially objective test. There must be the presence of conduct that falls short of the standard of a reasonable person in the position of the entity. Dishonesty is not an element of establishing recklessness. The actual intention of the entity is of no relevance.[44] Depending on the circumstances, behaviour that constitutes recklessness by a registered tax practitioner may differ to the type of behaviour that constitutes recklessness by a client.

- Recklessness must relate to the operation of a ‘taxation law’ which is defined in subsection 995-1(1) of the Income Tax Assessment Act 1997 (ITAA 1997) to mean:

- an Act of which the Commissioner has the general administration (including a part of an Act to the extent to which the Commissioner has the general administration of the Act); or

- legislative instruments made under such an Act (including such a part of an Act); or

- the TASA or regulations made under the TASA.

'Intentional disregard of a taxation law'

- Having regard to the ordinary meaning[45] of this term, the purpose of the provision and its statutory context, intentional disregard means an intent and purposeful decision to leave something out of consideration. Unlike recklessness, 'intentional' requires something more than reckless disregard of, or indifference to, a taxation law.

- In contrast to the objective test which applies to determine whether there has been a lack of reasonable care or reckless behaviour, the test for intentional disregard is purely subjective in nature. The actual intention of the entity in question is a key factor in determining whether there has been an intentional disregard for a taxation law. Further, dishonesty is a requisite feature of behaviour that shows an intentional disregard for the operation of the law. This is another significant difference between this type of behaviour and behaviour that shows a lack of reasonable care or recklessness where dishonesty is not an element.[46]

- Further, intentional disregard means that there must be actual knowledge that the statement made is false. To establish intentional disregard, the entity must have understood the effect of the relevant legislation and how it operates in respect of the statement made or prepared (or directed or permitted to be made or prepared) and make a deliberate choice to ignore the law.[47]

- In addition, the intentional disregard must be in the context of a ‘taxation law’ which is defined in subsection 995-1(1) of the Income Tax Assessment Act 1997 (ITAA 1997) to mean:

- an Act of which the Commissioner has the general administration (including a part of an Act to the extent to which the Commissioner has the general administration of the Act); or

- legislative instruments made under such an Act (including such a part of an Act); or

- the TASA or regulations made under the TASA.

- As discussed below, what constitutes ‘intentional disregard’ in any given scenario will ultimately depend on the facts and circumstances and must be considered on a case-by-case basis. Depending on the circumstances, behaviour that constitutes an intentional disregard of a taxation law by a registered tax practitioner may differ according to the type of behaviour that constitutes intentional disregard of a taxation law by a client.

Not reasonably satisfied that a client has corrected the statement

- Having regard to the ordinary meaning of the terms[48] and having regard to the purpose of the provision and its statutory context, the phrase ‘not reasonably satisfied’ means not having a sound basis to be assured that the client has corrected the statement.

- The foundation or basis for a registered tax practitioner being ‘reasonably satisfied’ that their client has corrected a false or misleading statement does not need to be established to a high evidentiary standard. This means there does not have to be conclusive proof. It is sufficient if a reasonable person, possessing the required knowledge, skill and experience of a registered tax practitioner would, when objectively considered, form the belief on the same grounds in the same circumstances.

- Making such a determination will depend on an analysis of the surrounding circumstances and consideration of a number of factors, including but not limited to:

- the registered tax practitioner’s ability to independently verify that the statement has been corrected (for example, through accessing the ATO’s systems)

- any responses or assurances provided by the client in relation to the registered tax practitioner’s advice about correcting the false or misleading statement

- the circumstances that led to the statement being false or misleading, and the role and conduct of the client in connection with the making of the false or misleading statement

- the registered tax practitioner’s familiarity and relationship with the client.

- As discussed below, what it means to be ‘reasonably satisfied’ in any given scenario will ultimately depend on the facts and circumstances and must be considered on a case-by-case basis.

Believe on reasonable grounds that the client’s actions have caused, are causing, or may still cause, substantial harm to the interests of others

- Having regard to the ordinary meaning of the terms[49] and having regard to the purpose of the provision and its statutory context, the phrase ‘believe on reasonable grounds’ requires the registered tax practitioner to have a sound foundation or basis in the circumstances on which to credit or form their belief.

- Further, it is established in case law that when legislation uses the term ‘reasonable grounds’ to describe a basis for a state of mind, for example, in forming a belief about a matter, there needs to be an existence of facts which are sufficient to induce that state of mind in a reasonable person.[50] Whether a person has reasonable grounds for a belief is an objective test, and it is irrelevant whether the person subjectively believes they have reasonable grounds. A ‘reasonable belief’ is a term that has been used in some criminal jurisdictions and is generally considered to infer a higher threshold than a ‘reasonable suspicion’.[51]